Form M-941w Wd - Employer'S Weekly Payment Of Income Taxes Withheld

ADVERTISEMENT

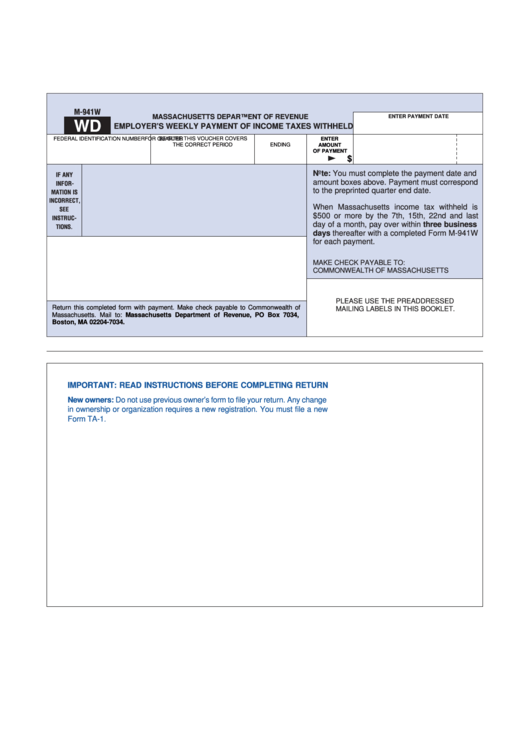

M-941W

MASSACHUSETTS DEPARTMENT OF REVENUE

ENTER PAYMENT DATE

WD

EMPLOYER’S WEEKLY PAYMENT OF INCOME TAXES WITHHELD

FEDERAL IDENTIFICATION NUMBER

BE SURE THIS VOUCHER COVERS

FOR QUARTER

ENTER

THE CORRECT PERIOD

ENDING

AMOUNT

OF PAYMENT

$

Note: You must complete the payment date and

IF ANY

amount boxes above. Payment must correspond

INFOR-

to the preprinted quarter end date.

MATION IS

INCORRECT,

When Massachusetts income tax withheld is

SEE

$500 or more by the 7th, 15th, 22nd and last

INSTRUC-

day of a month, pay over within three business

TIONS.

days thereafter with a completed Form M-941W

for each payment.

MAKE CHECK PAYABLE TO:

COMMONWEALTH OF MASSACHUSETTS

PLEASE USE THE PREADDRESSED

Return this completed form with payment. Make check payable to Commonwealth of

MAILING LABELS IN THIS BOOKLET.

Massachusetts. Mail to: Massachusetts Department of Revenue, PO Box 7034,

Boston, MA 02204-7034.

IMPORTANT: READ INSTRUCTIONS BEFORE COMPLETING RETURN

New owners: Do not use previous owner’s form to file your return. Any change

in ownership or organization requires a new registration. You must file a new

Form TA-1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1