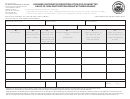

Form Rpd-41188 - Non-Participating Manufacturer Brand Cigarettes Distributed Or Sold Page 3

ADVERTISEMENT

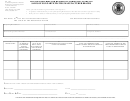

RPD 41188

State of New Mexico - Taxation and Revenue Department

Rev. 07/2010

Non-Participating Manufacturer Brand Cigarettes Distributed or Sold

Instructions

Page 2 of 2

to the Cigarette Tax Act.

Column C: Enter the number of qualifying NPM cigarette sticks (tax-exempt

stamps applied) distributed or sold in New Mexico during the report month.

Instructions for Completing this Form:

Include all cigarettes and “little cigars” to which you have affixed a New Mexico

tax-exempt stamp.

Enter your business name and New Mexico CRS Identification Number as

they appear on the New Mexico CRS Registration Certificate. Enter the federal

Column D: Enter the number of qualifying NPM cigarette sticks (tax-credit

employer identification number (FEIN) or social security number (SSN); if you

stamps applied) distributed or sold in New Mexico during the report month.

are a manufacturer or distributor, enter the New Mexico cigarette distributor’s or

Include all cigarettes and “little cigars” to which you have affixed a New Mexico

manufacturer’s license number, and a contact name and telephone number of

tax-credit stamp.

an individual authorized to answer questions about this report. The authorized

Column E: Enter the number of ounces of NPM roll-your-own tobacco distrib-

contact must also sign the report. Provide the information requested about

cigarettes and roll-your-own tobacco products that were made by an NPM,

uted or sold in New Mexico during the report month.

that your organization affixed a New Mexico excise tax stamp, New Mexico

Column F: If known, enter the name and address of the non-participating

tax-exempt stamp or tax-credit stamp, or otherwise paid the tobacco excise

manufacturer who produced the tobacco product.

tax, and that you distributed or sold during the report month. Important: Do not

include cigarettes that were purchased with a New Mexico excise tax stamp,

Column G: Enter the name and address of the distributor or wholesaler from

New Mexico tax-exempt stamp or tax-credit stamp already affixed.

whom you purchased the NPM product, if different from column F.

Column A: Enter the full brand family name of the qualifying NPM cigarettes

Sign the form, attach to Form RPD-41315, Cigarette Distributor’s Monthly Ciga-

distributed or sold during the report month. Do not abbreviate the brand family

rette Distributor Report, Form RPD-41311, Cigarette Manufacturer’s Monthly

name. All styles of cigarettes, such as regular, menthol, light, etc., sold under

Distribution Report, or Form RPD-41192, Tobacco Products Tax Return, and

the same trademark or brand family, must be included in the same line item.

mail on or before the 25th day following the close of the report month. Please

For example, the tobacco product “Alpha Bravo Gold Lights” should be reported

include the contact information of an individual authorized to speak for your

within the same line item as all “Alpha Bravo Gold” products.

business.

Column B: Enter the number of qualifying NPM cigarette sticks (20 stick stamps

Mail to: New Mexico Taxation and Revenue Department, Cigarette Tax

and 25 stick stamps applied) distributed or sold in New Mexico during the report

Unit, P.O. Box 25123, Santa Fe, NM 87504-5123

month. Include all cigarettes and little cigars to which you have affixed a New

Mexico excise tax stamp.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3