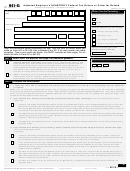

Form 941-X: Which process should you use?

Type of errors

you are

correcting

Use the adjustment process to correct underreported amounts.

Underreported

• Check the box on line 1.

amounts

ONLY

• Pay the amount you owe from line 20 by the time you file Form 941-X.

If you are filing Form 941-X

The process you

Choose either the adjustment process or the claim

Overreported

use depends on

MORE THAN 90 days before

process to correct the overreported amounts.

amounts

when you file

the period of limitations on

ONLY

Choose the adjustment process if you want the

credit or refund for Form 941

Form 941-X.

amount shown on line 20 credited to your Form 941,

or Form 941-SS expires...

Form 941-SS, or Form 944 for the period in which you

file Form 941-X. Check the box on line 1.

OR

Choose the claim process if you want the amount

shown on line 20 refunded to you or abated. Check

the box on line 2.

If you are filing Form 941-X

You must use the claim process to correct the

WITHIN 90 days of the

overreported amounts. Check the box on line 2.

expiration of the period of

limitations on credit or refund

for Form 941 or Form 941-SS...

The process you

If you are filing Form 941-X

Choose either the adjustment process or both the

BOTH

use depends on

MORE THAN 90 days before

adjustment process and the claim process when you

underreported

when you file

the period of limitations on

correct both underreported and overreported

and

credit or refund for Form 941

Form 941-X.

amounts.

overreported

or Form 941-SS expires...

amounts

Choose the adjustment process if combining your

underreported amounts and overreported amounts results

in a balance due or creates a credit that you want applied

to Form 941, Form 941-SS, or Form 944.

• File one Form 941-X, and

• Check the box on line 1 and follow the instructions

on line 20.

OR

Choose both the adjustment process and the

claim process if you want the overreported amount

refunded to you or abated.

File two separate forms.

1. For the adjustment process, file one Form 941-X

to correct the underreported amounts. Check the

box on line 1. Pay the amount you owe from line

20 by the time you file Form 941-X.

2. For the claim process, file a second Form 941-X

to correct the overreported amounts. Check the

box on line 2.

If you are filing Form 941-X

You must use both the adjustment process and

the claim process.

WITHIN 90 days of the

expiration of the period of

File two separate forms.

limitations on credit or

1. For the adjustment process, file one Form 941-X to

refund for Form 941 or

correct the underreported amounts. Check the box

Form 941-SS...

on line 1. Pay the amount you owe from line 20 by

the time you file Form 941-X.

2. For the claim process, file a second Form 941-X to

correct the overreported amounts. Check the box

on line 2.

4

941-X

Page

Form

(Rev. 4-2014)

1

1 2

2 3

3 4

4