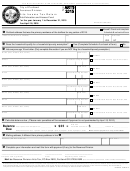

Form Dr-904 - Pollutants Tax Return - 2015 Page 5

ADVERTISEMENT

00003

DR-904

R. 01/13

Page 5

of a product which is not a pollutant.

pollutant subject to tax.

Note - The credit or refund shall not exceed the amount of the tax. Do not

report credits generated from tax-paid petroleum products transferred

to a registered IRS terminal on Line 31.

Any person subject to the pollutants tax or any person who uses tax-paid

pollutants, other than a retail dealer, must:

Ethanol Blends: Ethanol blends are taxable products resulting from a

blend of gasoline and ethanol to create a fuel grade ethanol. Fuel grade

percent gasoline pursuant to the Federal Bureau of Alcohol, Tobacco and

Firearms, Department of the Treasury, to render the product unsuitable for

Credit on Tax-paid Petroleum Products Transferred to a Registered

human consumption. Report fuel grade ethanol on Page 2, Schedule D,

Line 19 of the Pollutants Tax Return (DR-904).

You make take a credit if you:

Biodiesel Blends: Biodiesel blended with petroleum diesel is a taxable

product and must be reported on Page 2. Schedule E of the Pollutants Tax

Return (DR-904). Note - Do not report pertroleum diesel, included in the

blend, on Page 2, Schedule E if pollutant taxes were previously paid.

DEDUCTIONS OR EXEMPTIONS

Coastal Protection:

Crude oil produced at a well site subject to regulation under s. 377.22, F.S.,

terminal supplier return.

and exported from that site by the producer exclusively by pipeline, truck, or

If you qualify, calculate the credit as follows:

rail to a destination outside the jurisdiction of this state without intermediate

storage or stoppage; solvents; motor oil; lubricants; and lead-acid batteries

(Total gallons of gasoline or ethanol reported on Schedule 1A of your

are exempt from the tax for coastal protection.

terminal supplier return, divided by 42, multiplied by .02 for coastal

protection, .05 for water quality, and .80 for inland protection).

Water Quality:

The credit amounts must be separately stated in the appropriate column

by tax type (i.e. coastal protection, water quality, and inland protection).

The credit amounts should never exceed the total pollutant taxes paid on

licensed importer or producer are exempt from the tax for water quality.

gasoline or gasohol for a collection period. This credit will allow you to

maintain tax unpaid product in the bulk transfer system.

which is not itself a pollutant are exempt from the tax for water quality.

or foreign commerce by a person licensed under Chapter 206, F.S.,

We will issue a credit memo in all cases where tax due has inadvertently

been overpaid. You may request a refund of the credit by submitting an

quality.

Application for Refund (DR-26) to the Department. The application may be

downloaded from our Internet site (

).

quality unless sold to a business engaged in the dry-cleaning industry.

Perchloroethylene is also exempt if exported or acquired for purposes

other than for use in a dry-cleaning facility.

Schedule A - Use Schedule A to report tax on solvents and

Inland Protection:

American Society for Testing and Materials (ASTM) grade no. 5 and no. 6

residual oils; asphalt oil; petrochemical feed stocks; pesticides; ammonia

5.9 cents per gallon as a solvent and $5.00 per gallon when

and chlorine; solvents; motor oil; and lubricants are exempt from the

used as a dry-cleaning solvent.

tax for inland protection. In addition, petroleum products bunkered into

marine vessels engaged in interstate or foreign commerce by a licensed

Line 1.

Enter all tax-paid and unpaid gallons of solvents sold or removed

from storage during the collection period.

products, are exempt from the tax for inland protection.

Line 2.

Add the gallons on which tax has been paid during the month to

the gallons on which the tax is not imposed and enter the result

from nonpetroleum-based oils or fats which is suitable for use

on Line 2.

in diesel-powered engines and has not been blended with

Line 3.

Enter the gallons exported during the month and the gallons

petroleum diesel. Biodiesel is not liable for pollutants tax.

consumed in production.

Line 4.

Subtract the sum of Lines 2 and 3 from Line 1. NOTE: Enter the

You may take credits or request refunds for the following:

number of tax unpaid gallons subject to tax.

Tax for inland protection and water quality:

Line 5.

Rate per gallon.

Line 6.

Tax due (Line 4 times Line 5).

marine vessels engaged in interstate and foreign commerce.

Tax for water quality:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6