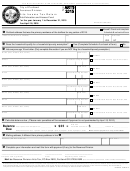

Form Dr-904 - Pollutants Tax Return - 2015 Page 6

ADVERTISEMENT

DR-904

R. 01/13

Page 6

Schedule B-Use Schedule B to report tax on motor oil and other

Line 26. Add the barrels on which tax has been paid during the month to

the barrels on which the tax is not imposed and enter the result on

tax for water quality.

Line 26.

Line 7.

Enter all tax-paid and unpaid gallons of motor oil and other

Line 27. Enter the barrels that have been exported during the month.

lubricants sold or removed from storage during the collection

period.

Line 28. Subtract the sum of Lines 26 and 27 from Line 25. NOTE: Enter

Line 8.

Add the gallons on which tax has been paid during the month to

the number of tax unpaid

subject to tax.

the gallons on which the tax is not imposed and enter the result

Line 29. Rate per barrel.

on Line 8.

Line 30. Tax due (Line 28 times Line 29).

Line 9.

Enter the gallons that have been exported during the month.

Line 31. Enter value (See “CREDITS AND REFUNDS” above).

Line 10. Subtract the sum of Lines 8 and 9 from Line 7. NOTE: Enter the

Line 32. Enter Value (See “Credit on tax-paid petroleum products

number of tax unpaid gallons subject to tax.

transferred to a registered IRS terminal” above).

Line 11. Rate per gallon.

Line 33. Subtract the sum of Line 6 plus Line 12 plus Line 18 plus Line 24

Line 12. Tax due (Line 10 times Line 11).

plus Line 30 from Lines 31 and 32 under each column and enter

Schedule C- Use Schedule C to report tax on ammonia. Ammonia is

the results.

Line 34. Enter the results of adding Columns 1, 2, 3, and 4, on Page 2,

Line 13. Enter all tax-paid and unpaid barrels of ammonia sold or removed

Line 33.

from storage during the collection period.

Line 35. Enter value (See

Line 14. Add the barrels on which tax has been paid during the month to

Revenue” above)

the barrels on which the tax is not imposed and enter the result on

Line 36. Subtract Line 35 from Line 34 and enter the result.

Line 14.

Line 15. Enter the barrels that have been exported during the month.

Line 37. Penalty: If your return or payment is late, enter 10 percent of

Line 16. Subtract the sum of Lines 14 and 15 from Line 13. NOTE: Enter

the tax due (Line 34 minus Line 35) for each month or fraction of

the number of tax unpaid

subject to tax.

the month that your return or payment is late. Penalty must not

Line 17. Rate per barrel.

exceed 50 percent of the tax due. The minimum penalty, even for

Line 18. Tax due (Line 16 times Line 17).

Line 38. Interest: If your payment is late, add interest to the total tax due

Schedule D - Use Schedule D to report tax on gasoline and gasohol.

(Line 34 minus Line 35). To calculate interest, multiply the tax

due (Line 34 minus Line 35) by the number of days late; then

protection, water quality, and inland protection.

Line 19. Enter all barrels of tax paid and unpaid gasoline and gasohol sold

or removed from storage during the collection period.

Line 39. Enter the sum of Lines 36, 37, and 38.

Line 20. Add the barrels on which tax has been paid during the month to

You must sign and date your DR-904

the barrels on which the tax is not imposed and enter the result on

Line 20.

Line 21. Enter the barrels that have been exported during the month.

Line 22. Subtract the sum of Lines 20 and 21 from Line 19. NOTE: Enter

the number of tax unpaid

subject to tax.

Line 23. Rate per barrel.

Line 24. Tax due (Line 22 times Line 23).

Schedule E -Use Schedule E to report tax on all diesel and other

Line 25. Enter all tax-paid and unpaid barrels of pollutants sold or removed

from storage during the collection period.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6