Instructions for Schedule 5—Tax on Oregon Moist Snuff (Definition B) on Units Above Floor

Introduction

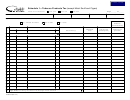

• Page ___ of ___. Fill in the page number and the total number of pages.

• Name. Fill in the name of your business or your name if this isn’t a business.

The Oregon tobacco tax return you must file depends on whether you are an

Oregon licensed distributor (Form 530), a consumer or other unlicensed person

• License number. Fill in your Oregon Other Tobacco Products distributor

or business (Form 531), or a tobacco manufacturer (Form 532). Schedule 5, Oregon

license, if you have one.

Moist Snuff Tax (Definition B) on Units Above Floor, is used with, and attached to,

• Social Security number . Enter your Social Security number if you’re an

your Oregon quarterly tobacco tax return, regardless of which return you must file.

individual reporting your purchases.

Use Schedule 5 to report purchases, related credits, and sales of moist snuff

• Business ID number (BIN). Enter your business identification number

( d efinition B) above the $2.14 (1.2 ounce) floor [moist snuff (definition B)]. On

(assigned to you by the Oregon Department of Revenue) if you’re a business

each form you use, check the box that shows the type of schedule it represents

reporting your purchases.

(for example: check box 5A if you’re using the form to report untaxed purchases).

• Quarter ending. Enter the month, day, and the year for the ending date of the

Report purchases, credits, and sales on separate schedules: Report purchases on

quarter you’re reporting (3/31/2012, 6/30/2012, 9/30/2012, or 12/31/2012).

Schedule 5A, credits on Schedule 5B, and sales on Schedule 5C.

Using the following instructions, fill in line information to correspond to what

What is moist snuff (definition B)?

you are reporting (untaxed purchases, credits, out-of-state, or exempt sales). Use a

For tax purposes, moist snuff (definition B) is any finely cut, ground, milled, or

single line for each transaction and provide all the information requested. Provide

powdered tobacco product that isn’t intended to be smoked or placed in the nasal

a subtotal for each page and a grand total on the last page.

cavity. OAR 150-323.500(9)

Column A

Submitting computer printouts

Enter the number of units of moist snuff (definition B) purchased, sold, or dis-

We’ll accept computer printouts of moist snuff (definition B) transactions in lieu

tributed.

of listing individual purchases, credits, or sales on this schedule. If you submit

Column B

computer printouts, you must also:

1. Use this form as a summary sheet for the accompanying printouts. Complete

Enter the wholesale price for each purchase, sale, or distribution of moist snuff

the top portion of this schedule. Write “see attached” on line 2. Enter the total

(definition B).

units of moist snuff (definition B) on line 20, column A; the total wholesale price

Column C

on line 20, column B; and the total ounces on line 20, column C.

2. Prepare your computer printouts using the same format and columnar sequence

Enter the total ounces for each purchase, sale, or distribution of moist snuff

as this form uses. If your computer can’t duplicate our format, submit a

(definition B). Report the column C grand total (last page) on Section 3 of

proposed format for our review. We’ll let you know if it’s satisfactory or what

your return.

changes you must make.

Instructions for untaxed purchase schedules—Schedule 5A

3. Use 8½ × 11-inch paper.

Group all purchases by manufacturer and provide a moist snuff (definition B)

Instructions for all schedules

subtotal for each manufacturer. On the last page of a purchase schedule, write

the total moist snuff (definition B) received from all manufacturers.

Please use blue or black ink when filling out this schedule. Enter information at

the top of the schedule as follows:

Itemize all untaxed moist snuff (definition B) purchases you received

In-state filers.

• Attach this schedule to. Check the box for the return you must file (Form 530,

during the quarter. This includes all free samples and promotional products. It

Form 531, or Form 532).

also includes moist snuff (definition B) you might sell out of state.

150-605-018 (Rev. 12-11)

1

1 2

2 3

3