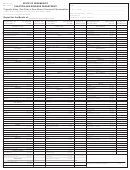

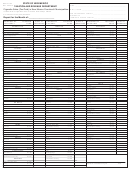

STATE OF NEW MEXICO

RPD-41183

Rev. 07/2010

TAXATION AND REVENUE DEPARTMENT

Cigarette Sales in New Mexico Counties & Municipalities - Instructions

WHO MUST REPORT:

Distributors who sell stamped cigarettes to a retail only business located in New Mexico, or who sell cigarettes at retail in

New Mexico, must submit Form RPD-41183, Cigarette Sales in New Mexico Counties and Municipalities, for each calendar

month. If during the report month, you did not make any retail sales or sales to a retail only establishment, enter "NONE" for

the "Total Cigarettes Sticks Sold". Each distributor, or facility owned by the distributor, must file a separate report.

DUE DATE OF REPORT:

Form RPD-41183, Cigarette Sales in New Mexico Counties and Municipalities, must be filed with the Taxation and Revenue

Department by the 25th day of the month following the close of the report period. A report period is a calendar month. Attach

the report to Form RPD-41315, Cigarette Distributor's Monthly Report, and mail to:

New Mexico Taxation and Revenue Department

Cigarette Tax Unit

P.O. Box 25123

Santa Fe, NM 87504-5123

For assistance, please call (505) 827-6842.

INSTRUCTIONS FOR COMPLETING THE REPORT:

Complete all information requested. Each facility must enter the federal employer identification number (FEIN) or social secu-

rity number (SSN), CRS identification number, the New Mexico distributor's license number and the name of the distributor.

Indicate the report period by entering the month and year. The count of cigarette sticks is required for each location in which

the taxed cigarettes were sold.

In the "sticks of cigarettes" column, after each New Mexico county or municipality in which stamped cigarettes were sold or

distributed to a retail only establishment, enter the number of cigarette sticks shipped to that location. Also enter the number

of cigarette sticks sold for each New Mexico county or municipality in which you sold stamped cigarettes at retail. Do not

include sales of stamped cigarettes shipped to other distributors for resale in New Mexico.

At the bottom of the report, enter the "Total Cigarette Sticks Sold". Sign and date the report.

Mail to:

State of New Mexico

Taxation and Revenue Department

P.O. Box 25123

Santa Fe, NM 87504-5123

1

1 2

2