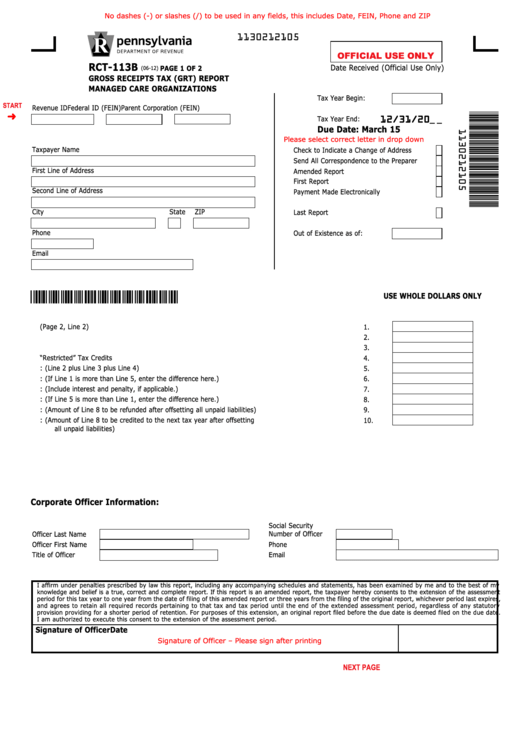

No dashes (-) or slashes (/) to be used in any fields, this includes Date, FEIN, Phone and ZIP

1130212105

OFFICIAL USE ONLY

RCT-113B

PAGE 1 OF 2

Date Received (Official Use Only)

(06-12)

GROSS RECEIPTS TAX (GRT) REPORT

MANAGED CARE ORGANIZATIONS

Tax Year Begin:

START

Revenue ID

Federal ID (FEIN)

Parent Corporation (FEIN)

Tax Year End:

12/31/20

_ _

Due Date: March 15

Please select correct letter in drop down

Taxpayer Name

Check to Indicate a Change of Address

Send All Correspondence to the Preparer

First Line of Address

Amended Report

First Report

Second Line of Address

Payment Made Electronically

City

State

ZIP

Last Report

Phone

Out of Existence as of:

Email

*1 1 3021 21 05*

USE WHOLE DOLLARS ONLY

1.

Gross Receipts Tax Managed Care Organizations (Page 2, Line 2)

1.

2.

Total Estimated Payments

2.

3.

Total Payments Carried Forward From Prior Year Return

3.

4.

Total “Restricted” Tax Credits

4.

5.

Total Credit: (Line 2 plus Line 3 plus Line 4)

5.

6.

Tax Due: (If Line 1 is more than Line 5, enter the difference here.)

6.

7.

Remittance: (Include interest and penalty, if applicable.)

7.

8.

OVERPAYMENT: (If Line 5 is more than Line 1, enter the difference here.)

8.

9.

Refund: (Amount of Line 8 to be refunded after offsetting all unpaid liabilities)

9.

10. Transfer: (Amount of Line 8 to be credited to the next tax year after offsetting

10.

all unpaid liabilities)

Corporate Officer Information:

Social Security

Number of Officer

Officer Last Name

Officer First Name

Phone

Title of Officer

Email

I affirm under penalties prescribed by law this report, including any accompanying schedules and statements, has been examined by me and to the best of my

knowledge and belief is a true, correct and complete report. If this report is an amended report, the taxpayer hereby consents to the extension of the assessment

period for this tax year to one year from the date of filing of this amended report or three years from the filing of the original report, whichever period last expires,

and agrees to retain all required records pertaining to that tax and tax period until the end of the extended assessment period, regardless of any statutory

provision providing for a shorter period of retention. For purposes of this extension, an original report filed before the due date is deemed filed on the due date.

I am authorized to execute this consent to the extension of the assessment period.

Signature of Officer

Date

Signature of Officer – Please sign after printing

Reset Entire Form

NEXT PAGE

PRINT FORM

1

1 2

2