General Information For Rct-131

ADVERTISEMENT

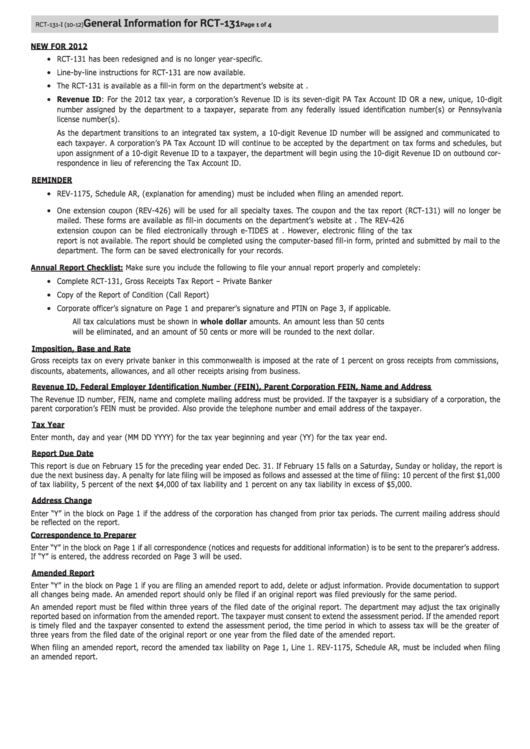

General Information for RCT-131

RCT-131-I (10-12)

Page 1 of 4

NEW FOR 2012

• RCT-131 has been redesigned and is no longer year-specific.

• Line-by-line instructions for RCT-131 are now available.

• The RCT-131 is available as a fill-in form on the department’s website at

• Revenue ID: For the 2012 tax year, a corporation’s Revenue ID is its seven-digit PA Tax Account ID OR a new, unique, 10-digit

number assigned by the department to a taxpayer, separate from any federally issued identification number(s) or Pennsylvania

license number(s).

As the department transitions to an integrated tax system, a 10-digit Revenue ID number will be assigned and communicated to

each taxpayer. A corporation’s PA Tax Account ID will continue to be accepted by the department on tax forms and schedules, but

upon assignment of a 10-digit Revenue ID to a taxpayer, the department will begin using the 10-digit Revenue ID on outbound cor-

respondence in lieu of referencing the Tax Account ID.

REMINDER

• REV-1175, Schedule AR, (explanation for amending) must be included when filing an amended report.

• One extension coupon (REV-426) will be used for all specialty taxes. The coupon and the tax report (RCT-131) will no longer be

mailed. These forms are available as fill-in documents on the department’s website at The REV-426

extension coupon can be filed electronically through e-TIDES at However, electronic filing of the tax

report is not available. The report should be completed using the computer-based fill-in form, printed and submitted by mail to the

department. The form can be saved electronically for your records.

Annual Report Checklist: Make sure you include the following to file your annual report properly and completely:

• Complete RCT-131, Gross Receipts Tax Report – Private Banker

• Copy of the Report of Condition (Call Report)

• Corporate officer’s signature on Page 1 and preparer’s signature and PTIN on Page 3, if applicable.

All tax calculations must be shown in whole dollar amounts. An amount less than 50 cents

will be eliminated, and an amount of 50 cents or more will be rounded to the next dollar.

Imposition, Base and Rate

Gross receipts tax on every private banker in this commonwealth is imposed at the rate of 1 percent on gross receipts from commissions,

discounts, abatements, allowances, and all other receipts arising from business.

Revenue ID, Federal Employer Identification Number (FEIN), Parent Corporation FEIN, Name and Address

The Revenue ID number, FEIN, name and complete mailing address must be provided. If the taxpayer is a subsidiary of a corporation, the

parent corporation’s FEIN must be provided. Also provide the telephone number and email address of the taxpayer.

Tax Year

Enter month, day and year (MM DD YYYY) for the tax year beginning and year (YY) for the tax year end.

Report Due Date

This report is due on February 15 for the preceding year ended Dec. 31. If February 15 falls on a Saturday, Sunday or holiday, the report is

due the next business day. A penalty for late filing will be imposed as follows and assessed at the time of filing: 10 percent of the first $1,000

of tax liability, 5 percent of the next $4,000 of tax liability and 1 percent on any tax liability in excess of $5,000.

Address Change

Enter “Y” in the block on Page 1 if the address of the corporation has changed from prior tax periods. The current mailing address should

be reflected on the report.

Correspondence to Preparer

Enter “Y” in the block on Page 1 if all correspondence (notices and requests for additional information) is to be sent to the preparer’s address.

If “Y” is entered, the address recorded on Page 3 will be used.

Amended Report

Enter “Y” in the block on Page 1 if you are filing an amended report to add, delete or adjust information. Provide documentation to support

all changes being made. An amended report should only be filed if an original report was filed previously for the same period.

An amended report must be filed within three years of the filed date of the original report. The department may adjust the tax originally

reported based on information from the amended report. The taxpayer must consent to extend the assessment period. If the amended report

is timely filed and the taxpayer consented to extend the assessment period, the time period in which to assess tax will be the greater of

three years from the filed date of the original report or one year from the filed date of the amended report.

When filing an amended report, record the amended tax liability on Page 1, Line 1. REV-1175, Schedule AR, must be included when filing

an amended report.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4