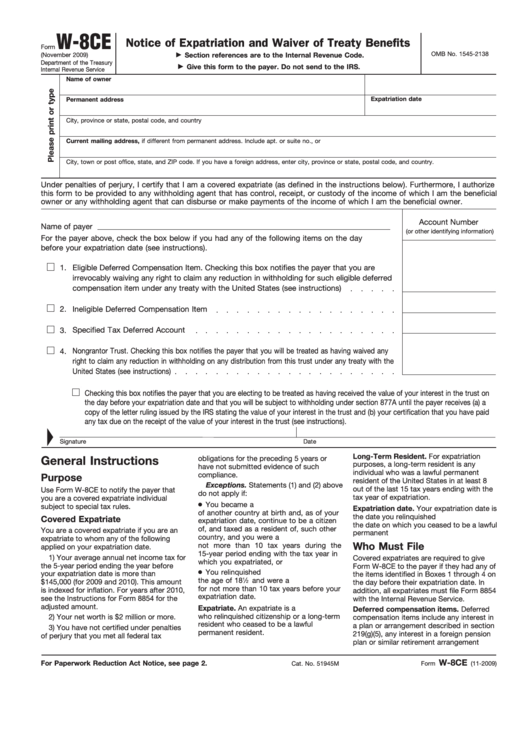

W-8CE

Notice of Expatriation and Waiver of Treaty Benefits

Form

OMB No. 1545-2138

(November 2009)

Section references are to the Internal Revenue Code.

Department of the Treasury

Give this form to the payer. Do not send to the IRS.

Internal Revenue Service

Name of owner

U.S. taxpayer identification number

Expatriation date

Permanent address

City, province or state, postal code, and country

Current mailing address, if different from permanent address. Include apt. or suite no., or P.O. box if mail is not delivered to street address.

City, town or post office, state, and ZIP code. If you have a foreign address, enter city, province or state, postal code, and country.

Under penalties of perjury, I certify that I am a covered expatriate (as defined in the instructions below). Furthermore, I authorize

this form to be provided to any withholding agent that has control, receipt, or custody of the income of which I am the beneficial

owner or any withholding agent that can disburse or make payments of the income of which I am the beneficial owner.

Account Number

Name of payer

(or other identifying information)

For the payer above, check the box below if you had any of the following items on the day

before your expatriation date (see instructions).

Eligible Deferred Compensation Item. Checking this box notifies the payer that you are

1.

irrevocably waiving any right to claim any reduction in withholding for such eligible deferred

compensation item under any treaty with the United States (see instructions)

2.

Ineligible Deferred Compensation Item

Specified Tax Deferred Account

3.

Nongrantor Trust. Checking this box notifies the payer that you will be treated as having waived any

4.

right to claim any reduction in withholding on any distribution from this trust under any treaty with the

United States (see instructions)

Checking this box notifies the payer that you are electing to be treated as having received the value of your interest in the trust on

the day before your expatriation date and that you will be subject to withholding under section 877A until the payer receives (a) a

copy of the letter ruling issued by the IRS stating the value of your interest in the trust and (b) your certification that you have paid

any tax due on the receipt of the value of your interest in the trust (see instructions).

Signature

Date

Long-Term Resident. For expatriation

General Instructions

obligations for the preceding 5 years or

purposes, a long-term resident is any

have not submitted evidence of such

individual who was a lawful permanent

compliance.

Purpose

resident of the United States in at least 8

Exceptions. Statements (1) and (2) above

out of the last 15 tax years ending with the

Use Form W-8CE to notify the payer that

do not apply if:

tax year of expatriation.

you are a covered expatriate individual

● You became a U.S. citizen and a citizen

subject to special tax rules.

Expatriation date. Your expatriation date is

of another country at birth and, as of your

the date you relinquished U.S. citizenship or

Covered Expatriate

expatriation date, continue to be a citizen

the date on which you ceased to be a lawful

of, and taxed as a resident of, such other

You are a covered expatriate if you are an

permanent U.S. resident.

country, and you were a U.S. resident for

expatriate to whom any of the following

not more than 10 tax years during the

Who Must File

applied on your expatriation date.

15-year period ending with the tax year in

1) Your average annual net income tax for

Covered expatriates are required to give

which you expatriated, or

the 5-year period ending the year before

Form W-8CE to the payer if they had any of

● You relinquished U.S. citizenship before

your expatriation date is more than

the items identified in Boxes 1 through 4 on

the age of 18

1

⁄

and were a U.S. resident

$145,000 (for 2009 and 2010). This amount

2

the day before their expatriation date. In

for not more than 10 tax years before your

is indexed for inflation. For years after 2010,

addition, all expatriates must file Form 8854

expatriation date.

see the Instructions for Form 8854 for the

with the Internal Revenue Service.

adjusted amount.

Expatriate. An expatriate is a U.S. citizen

Deferred compensation items. Deferred

who relinquished citizenship or a long-term

2) Your net worth is $2 million or more.

compensation items include any interest in

resident who ceased to be a lawful

a plan or arrangement described in section

3) You have not certified under penalties

permanent resident.

219(g)(5), any interest in a foreign pension

of perjury that you met all federal tax

plan or similar retirement arrangement

W-8CE

For Paperwork Reduction Act Notice, see page 2.

Cat. No. 51945M

Form

(11-2009)

1

1 2

2