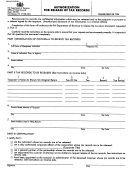

INSTRUCTIONS

PART I

Your designation identifies to the PA Department of Revenue the person, firm or agency to whom/which the PA Department of Revenue

should send the tax records you authorize for release.

Lines 1-4

- If you authorize the release of your tax records to an agency or firm (such as a government agency, scholarship board or

mortgage lender) on line 2, you must include the name of an individual we may contact and a daytime telephone number. Complete all

address information on lines 3 and 4.

PART II

Item 1. - If you authorize the release of a joint Personal Income Tax return, indicate the names of both spouses as shown on the

original return.

Item 2. - For Personal Income Tax records, enter your Social Security Number. For joint tax records, also enter your spouse’s Social Security

Number. Please include this information to expedite processing your request.

If corporate tax records are requested, enter the corporation tax file (box) number.

If sales tax records are requested, enter the sales tax license number.

Item 3. - Specify the kind of tax records to be released using the following abbreviations: Personal Income Tax (PIT), Corporation Tax (CT),

Sales and Use Tax (S&U), Employer Withholding (EMP).

Item 4. - Enter the record requested, for example, tax return, report or schedule.

Item 5. - Enter the year(s) of the tax records you are requesting. For fiscal year filers, enter the period ending date. If you request more

that five different periods, use additional forms. Returns filed five or more years ago may not be available for release.

Item 6. - Enter your current street address.

Item 7. - If same as in Item 6, enter “Same.”

PART III

The PA Department of Revenue will accept only an original dated release signed by the taxpayer identifying the specific tax records and tax

years.

If you are not the taxpayer described in Part II, you must submit to the department a copy of your authorization to request the release of

the tax records. This usually will be a power of attorney on tax matters or, if the taxpayer is deceased, sufficient evidence to establish that

you are authorized to act for the taxpayer’s estate.

Copies of joint returns may be furnished at the request of either the husband or the wife. Only one signature is required.

Corporate tax records are available for release only by a duly authorized officer.

Partnership tax records are available for release only by a general partner.

WHERE TO FILE — Send the completed form to:

PA DEPARTMENT OF REVENUE

DIRECTOR’S OFFICE

BUREAU OF ADMINISTRATIVE SERVICES

12TH FL STRAWBERRY SQ

HARRISBURG PA 17128-1200

Please allow four to six weeks for your request to be processed.

RESET FORM

PREVIOUS PAGE

PRINT FORM

1

1 2

2