Form Ct-243 - Claim For Biofuel Production Credit - 2013

ADVERTISEMENT

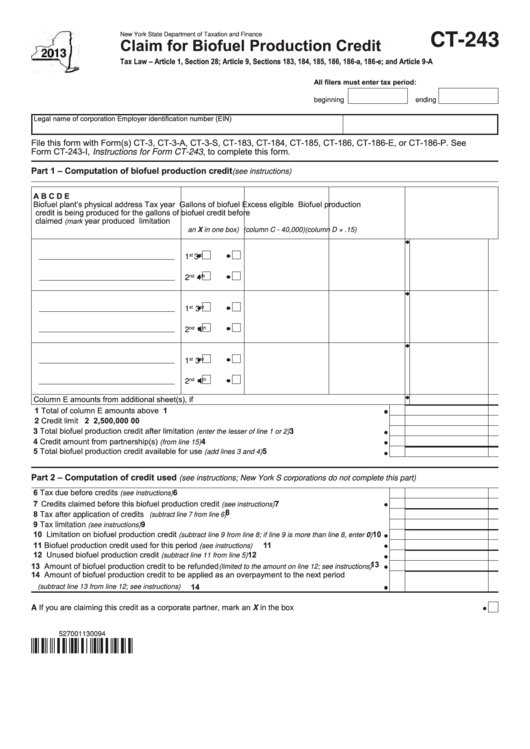

New York State Department of Taxation and Finance

CT-243

Claim for Biofuel Production Credit

Tax Law – Article 1, Section 28; Article 9, Sections 183, 184, 185, 186, 186-a, 186-e; and Article 9-A

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number (EIN)

File this form with Form(s) CT-3, CT-3-A, CT-3-S, CT-183, CT-184, CT-185, CT-186, CT-186-E, or CT-186-P. See

Form CT-243-I, Instructions for Form CT-243, to complete this form.

Part 1 – Computation of biofuel production credit

(see instructions)

A

B

C

D

E

Biofuel plant’s physical address

Tax year

Gallons of biofuel

Excess eligible

Biofuel production

credit is being

produced for the

gallons of biofuel

credit before

year

produced

limitation

claimed

(mark

an X in one box)

(column C - 40,000)

(column D × .15)

st

rd

1

3

2

nd

4

th

1

st

3

rd

nd

th

2

4

st

rd

1

3

2

nd

4

th

Column E amounts from additional sheet(s), if any..........................................................................................

1 Total of column E amounts above ......................................................................................................

1

2 Credit limit ............................................................................................................................................

2

2,500,000 00

3 Total biofuel production credit after limitation

..........................................

3

(enter the lesser of line 1 or 2)

4 Credit amount from partnership(s)

..................................................................................

4

(from line 15)

5 Total biofuel production credit available for use

......................................................

5

(add lines 3 and 4)

Part 2 – Computation of credit used

(see instructions; New York S corporations do not complete this part)

6 Tax due before credits

.................................................................................................

6

(see instructions)

7 Credits claimed before this biofuel production credit

................................................

7

(see instructions)

8 Tax after application of credits

..........................................................................

8

(subtract line 7 from line 6)

9 Tax limitation

...............................................................................................................

9

(see instructions)

10 Limitation on biofuel production credit

......

10

(subtract line 9 from line 8; if line 9 is more than line 8, enter 0)

11 Biofuel production credit used for this period

............................................................

11

(see instructions)

12 Unused biofuel production credit

................................................................

12

(subtract line 11 from line 5)

13 Amount of biofuel production credit to be refunded

.....

13

(limited to the amount on line 12; see instructions)

14 Amount of biofuel production credit to be applied as an overpayment to the next period

.......................................................................................

14

(subtract line 13 from line 12; see instructions)

A If you are claiming this credit as a corporate partner, mark an X in the box ...................................................................................

527001130094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2