Form Ct-40 - Claim For Alternative Fuels Credit - 2013

ADVERTISEMENT

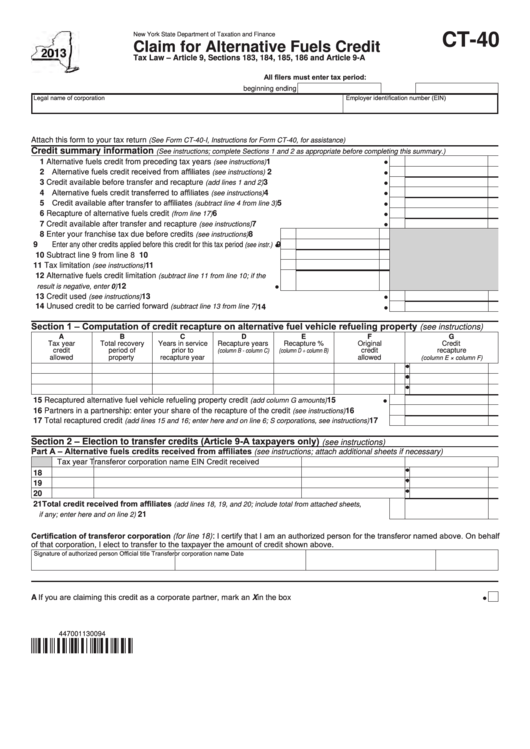

New York State Department of Taxation and Finance

CT‑40

Claim for Alternative Fuels Credit

Tax Law – Article 9, Sections 183, 184, 185, 186 and Article 9‑A

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number (EIN)

Attach this form to your tax return

(See Form CT-40-I, Instructions for Form CT-40, for assistance)

Credit summary information

(See instructions; complete Sections 1 and 2 as appropriate before completing this summary.)

1 Alternative fuels credit from preceding tax years

...................................................

1

(see instructions)

2 Alternative fuels credit received from affiliates

......................................................

2

(see instructions)

3 Credit available before transfer and recapture

....................................................

3

(add lines 1 and 2)

4 Alternative fuels credit transferred to affiliates

......................................................

4

(see instructions)

5 Credit available after transfer to affiliates

................................................

5

(subtract line 4 from line 3)

6 Recapture of alternative fuels credit

...........................................................................

6

(from line 17)

7 Credit available after transfer and recapture

.........................................................

7

(see instructions)

8 Enter your franchise tax due before credits

...........

8

(see instructions)

9 Enter any other credits applied before this credit for this tax period

9

(see instr.)

10 Subtract line 9 from line 8 ............................................................... 10

11 Tax limitation

......................................................... 11

(see instructions)

12 Alternative fuels credit limitation

(subtract line 11 from line 10; if the

..............................................................

12

result is negative, enter 0)

13 Credit used

............................................................................................................

13

(see instructions)

14 Unused credit to be carried forward

.......................................................

(subtract line 13 from line 7)

14

Section 1 – Computation of credit recapture on alternative fuel vehicle refueling property

(see instructions)

A

B

C

D

E

F

G

Tax year

Total recovery

Years in service

Recapture years

Recapture %

Original

Credit

credit

period of

prior to

credit

recapture

(column B - column C)

(column D ÷ column B)

allowed

property

recapture year

allowed

(column E × column F)

15 Recaptured alternative fuel vehicle refueling property credit

........................

15

(add column G amounts)

16 Partners in a partnership: enter your share of the recapture of the credit

................. 16

(see instructions)

17 Total recaptured credit

....... 17

(add lines 15 and 16; enter here and on line 6; S corporations, see instructions)

Section 2 – Election to transfer credits (Article 9-A taxpayers only)

(see instructions)

Part A – Alternative fuels credits received from affiliates

(see instructions; attach additional sheets if necessary)

Tax year

Transferor corporation name

EIN

Credit received

18

19

20

21 Total credit received from affiliates

(add lines 18, 19, and 20; include total from attached sheets,

.......................................................................................................... 21

if any; enter here and on line 2)

Certification of transferor corporation (for line 18)

I certify that I am an authorized person for the transferor named above. On behalf

:

of that corporation, I elect to transfer to the taxpayer the amount of credit shown above.

Signature of authorized person

Official title

Transferor corporation name

Date

A If you are claiming this credit as a corporate partner, mark an X in the box .....................................................................................

447001130094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2