Form Il-1120-St - Small Business Corporation Replacement Tax Return - 2012

ADVERTISEMENT

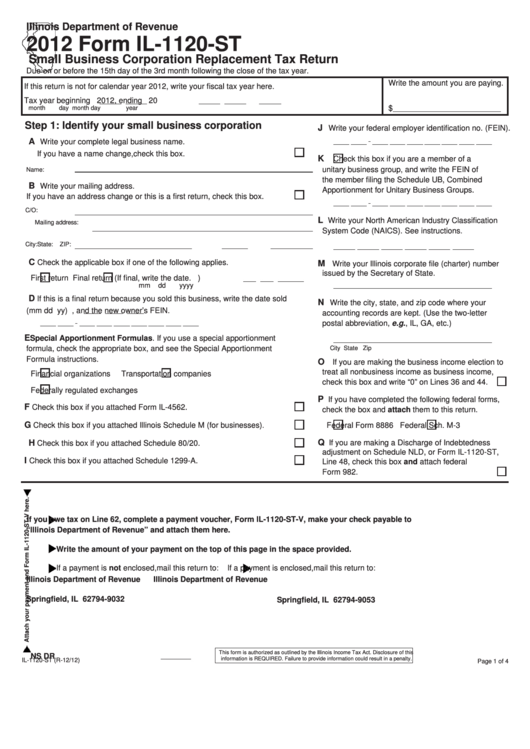

Illinois Department of Revenue

2012 Form IL-1120-ST

Small Business Corporation Replacement Tax Return

Due on or before the 15th day of the 3rd month following the close of the tax year.

Write the amount you are paying.

If this return is not for calendar year 2012, write your fiscal tax year here.

Tax year beginning

2012, ending

20

$

month

day

month

day

year

Step 1: Identify your small business corporation

J

Write your federal employer identification no. (FEIN).

A

Write your complete legal business name.

If you have a name change, check this box.

K

Check this box if you are a member of a

unitary business group, and write the FEIN of

Name:

the member filing the Schedule UB, Combined

B

Write your mailing address.

Apportionment for Unitary Business Groups.

If you have an address change or this is a first return, check this box.

C/O:

L

Write your North American Industry Classification

Mailing address:

System Code (NAICS). See instructions.

City:

State:

ZIP:

C

Check the applicable box if one of the following applies.

M

Write your Illinois corporate file (charter) number

issued by the Secretary of State.

First return

Final return (If final, write the date.

)

mm

dd

yyyy

D

If this is a final return because you sold this business, write the date sold

N

Write the city, state, and zip code where your

(mm dd yy)

, and the new owner’s FEIN.

accounting records are kept. (Use the two-letter

postal abbreviation, e.g., IL, GA, etc.)

E

Special Apportionment Formulas. If you use a special apportionment

formula, check the appropriate box, and see the Special Apportionment

City

State

Zip

Formula instructions.

O

If you are making the business income election to

treat all nonbusiness income as business income,

Financial organizations

Transportation companies

check this box and write “0” on Lines 36 and 44.

Federally regulated exchanges

P

If you have completed the following federal forms,

F

Check this box if you attached Form IL-4562.

check the box and attach them to this return.

G

Check this box if you attached Illinois Schedule M (for businesses).

Federal Form 8886

Federal Sch. M-3

Q

H

If you are making a Discharge of Indebtedness

Check this box if you attached Schedule 80/20.

adjustment on Schedule NLD, or Form IL-1120-ST,

I

Check this box if you attached Schedule 1299-A.

Line 48, check this box and attach federal

Form 982.

If you owe tax on Line 62, complete a payment voucher, Form IL-1120-ST-V, make your check payable to

“Illinois Department of Revenue” and attach them here.

Write the amount of your payment on the top of this page in the space provided.

If a payment is not enclosed, mail this return to:

If a payment is enclosed, mail this return to:

Illinois Department of Revenue

Illinois Department of Revenue

P.O. Box 19032

P.O. Box 19053

Springfield, IL 62794-9032

Springfield, IL 62794-9053

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

NS

DR

information is REQUIRED. Failure to provide information could result in a penalty.

IL-1120-ST (R-12/12)

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4