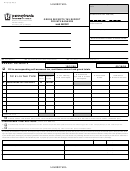

RCT-131

PAGE 2 OF 3

Revenue ID

(06-12)

GROSS RECEIPTS TAX - PRIVATE BANKERS

GROSS RECEIPTS FROM THE FOLLOWING SOURCES:

USE WHOLE DOLLARS ONLY

1. Commissions on loans and various banking services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

2. Discounts on loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

3. Abatements or allowances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

4. Banking charges or fees on depositors accounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

5. Rents on real estate owned . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

6. Interest on:

a.

Bonds of public and private corporations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

b.

Bonds of states other than the Commonwealth of Pennsylvania . . . . . . . . . . . . . . . . .$

c.

Bonds issued by municipal subdivisions of the Commonwealth of Pennsylvania . . . . . .$

d.

Loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

e.

Mortgages and judgments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

f.

Drawing accounts or overdrafts of partners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

g.

Balances with other banks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

h.

Total interest (sum of 6a through 6g) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

i.

Less: amortization of premiums, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

j.

Total interest less amortization of premiums (6h less 6

i

)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

7. Dividends on stocks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

8. Purchases and sales of securities for investment or trading purposes:

a.

Profits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

b.

Losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

c.

Profits less losses on purchases and sales of securities for investment or trading purposes (8a less 8b) . . . . . . .$

9. Rental of safe-deposit boxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

10. Other sources:

a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

c. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

d. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

e.

Total of other sources (sum of 10a through 10d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

11. Total gross receipts (sum of Lines 1 through 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

(Interest on obligations of the U.S. and interest on obligations of the

Commonwealth of Pennsylvania are not taxable.)

12. Tax (Line 11 times tax rate - See Instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

Page 3 must be completed and included with report.

Reset Entire Form

RETURN TO PAGE 1

NEXT PAGE

PRINT FORM

1

1 2

2 3

3