WHO MUST FILE THIS RETURN

DUE DATE OF RETURN – September 30, 2009

All retailers who sell cigarettes in Wisconsin must complete

Sign, date, and mail your return plus remittance on or before

and file this return.

September 30, 2009.

Returns filed after that date are

subject to late-filing charges (see instructions for lines 6 and

INVENTORY TAX RATE

7).

On September 1, 2009, the Wisconsin excise tax on

cigarettes will increase from 8.85¢ to 12.6¢ per single

WHERE TO FILE YOUR RETURN

cigarette. This results in a $0.75 tax increase on a pack of

Mail your completed return and remittance to:

20 cigarettes (from $1.77 to $2.52 per pack). The tax on

Wisconsin Department of Revenue

packs of 25 will increase from $2.2125 to $3.15 per pack.

Mail Stop 5-107

PO Box 8900

TAKING YOUR CIGARETTE INVENTORY

Madison, WI 53708-8900

You are required to inventory all your unsold cigarettes,

regardless where stored, as of midnight on August 31, 2009.

RECORD KEEPING

You must keep a complete copy of your return and all

When you take inventory, count all full cartons and all

records used in preparing this return for at least four years.

individual (loose) packs of cigarettes received and in your

The records must be kept in a place and manner easily

possession by midnight August 31, 2009 (regardless where

accessible for review by department representatives.

stored). Include in your inventory all unsalable cigarettes

which you have not yet returned to your supplier.

ASSISTANCE AND FORMS

Assistance and forms are available at:

CIGARETTES IN VENDING MACHINES

2135 Rimrock Road

If you purchase cigarettes and place them in vending

Madison, Wisconsin 53713

machines located on your retail premises, you must include

(608) 266-8970 or

them in your inventory. However, if the cigarettes are owned

(608) 266-6701

and supplied by another cigarette vendor, that vendor is

responsible for taking inventory of the cigarettes in the

or write to:

vending machines and paying the cigarette inventory tax.

Mail Stop 5-107

Enter the vendor's permit number, as shown on the vending

PO Box 8900

machine, in the space provided on line 1 next to the

Madison, WI 53708-8900

appropriate check box on the front of this return.

E-mail:

excise@revenue.wi.gov

MULTIPLE RETAIL LOCATIONS

COMPLETING YOUR RETURN

Persons or businesses who hold a Cigarette Multiple

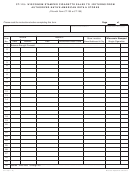

Inventory your cigarettes as previously described and

Retailer Permit, (e.g., (F)CMR-0000), must file and pay the

complete the front of this return computing the cigarette

inventory tax for all retail locations covered by the permit on

inventory tax you owe.

the Cigarette Permitee Inventory Tax Return (Form CT-138),

as instructed below.

If you do not have any cigarettes in inventory at the

beginning of business on September 1, 2009, check the

For all others if you have more than one retail location, you

appropriate box above the computation schedule.

must take a separate inventory of each location. Prepare

Line 6 LATE-FILING FEE – Any return not filed by the due

and file one inventory tax return (Form CT-139) for each

location.

Use the preprinted retail inventory tax return(s)

date of September 30, 2009, is subject to a statutory $10

mailed by the department. If you did not receive a tax return

late-filing fee. If you are filing this return after September 30,

for one of your locations, contact the department for a

2009, enter $10 on line 6.

preprinted form (see “Assistance and Forms”).

Pay by

separate check for each location and attach it to the

Line 7 INTEREST

–

If

this

return

is

filed

after

appropriate return; or group no more than eight individual tax

September 30, 2009, interest must be calculated on any tax

returns and pay this combined total amount due on one

due (line 6). Interest is computed on the tax due at the rate

check. Attach an add tape labeled “COMBINED” showing

of 1.5% per month (.0005 per day) from the due date of the

the eight or less return’s total amount due and the grand

return until date of tax payment.

Enter the interest

total (check amount) and attach it and the check to the

calculated on line 7.

return on top.

For example, if you are filing a return 20 days late, compute

WHOLESALE AND RETAIL PERMIT TYPES

the interest to enter on line 7 as follows:

If you receive more than one cigarette inventory tax return,

Multiply tax due on line 5 x .0005 x 20 days = Interest

compute your inventory tax on the return that contains your

Wisconsin cigarette permit number (e.g., prefix of CMR,

Line 8 TOTAL AMOUNT DUE – Add lines 5, 6, and 7.

FCMR, CV, FCV, CJ, FCJ, CD, or FCD, plus the four digit

Enter the total amount due on line 8. Recheck your math

number).

Separate and label wholesale and retail

and decimal placements. Make your check or money order

payable to the Wisconsin Department of Revenue. Do not

inventories on an attached schedule. Attach all other returns

you received to the back of your completed permittee return.

use electronic funds transfer (EFT) to pay the tax due with

this return.

1

1 2

2