Form Mt-45 Schedule D - Tax-Free Sales And Use

ADVERTISEMENT

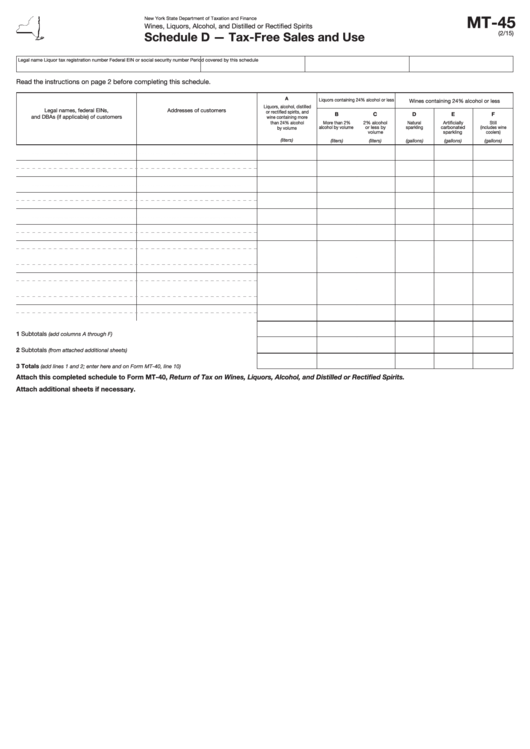

MT-45

New York State Department of Taxation and Finance

Wines, Liquors, Alcohol, and Distilled or Rectified Spirits

Schedule D — Tax-Free Sales and Use

(2/15)

Legal name

Liquor tax registration number

Federal EIN or social security number

Period covered by this schedule

Read the instructions on page 2 before completing this schedule.

A

Liquors containing 24% alcohol or less

Wines containing 24% alcohol or less

Liquors, alcohol, distilled

Legal names, federal EINs,

Addresses of customers

or rectified spirits, and

B

C

D

E

F

and DBAs (if applicable) of customers

wine containing more

than 24% alcohol

More than 2%

2% alcohol

Natural

Artificially

Still

alcohol by volume

or less by

sparkling

carbonated

(includes wine

by volume

volume

sparkling

coolers)

(liters)

(liters)

(liters)

(gallons)

(gallons)

(gallons)

1

Subtotals

................................................................................

(add columns A through F)

2

Subtotals

.......................................................................

(from attached additional sheets)

3

Totals

........................................

(add lines 1 and 2; enter here and on Form MT-40, line 10)

Attach this completed schedule to Form MT-40, Return of Tax on Wines, Liquors, Alcohol, and Distilled or Rectified Spirits.

Attach additional sheets if necessary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2