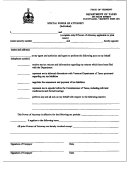

Form Pa-1 - Special Power Of Attorney (Individual) Page 4

ADVERTISEMENT

LINE BY LINE INSTRUCTIONS FOR SPECIAL POA (Individual)

1. Print name.

12. List any prior Powers of Attorney on file with the

Department of Taxes which are NOT revoked.

2. Social Security Number.

13. Signature of person on Line 1 and date POA is signed.

3. Print Spouse or CU Partner name, if applicable. If

Power of Attorney is applicable to a joint return(s), each

14. Signature of person on Line 3 (if applicable) and date

Spouse or CU Partner must be named.

POA is signed.

4. Social Security Number of Spouse or CU Partner, if

15. Print name of witness to signature of person listed on

applicable.

Line 1.

5. Print name of Agent.

16. Signature of witness to person listed on Line 1.

6. Print telephone number of Agent.

17. To be filled out and signed by Notary Public for person

listed on Line 1.

7. Print address of Agent.

18. Signature of agent and date agent signed.

8. Check applicable boxes and/or provide specific instruc-

tions.

NOTE: Lines 19 through 22 apply only in the case of a

9. State any special skills or expertise of agent which will

joint return(s). If not applicable, leave blank.

be exercised by agent on behalf of principal, such as

19. Print name of witness to signature of person listed on

CPA, RPA, tax preparer, attorney-at-law. If none, write

Line 3.

“NONE”.

20. Signature of witness to person listed on Line 3.

10. List specific tax periods (i.e., “2002”) for which Agent

is authorized to act on your behalf. If all tax periods,

21. To be filled out and signed by Notary Public for person

write “ALL”.

listed on Line 3.

11. List specific tax types (i.e., “Income tax”) for which Agent

22. Signature of agent and date agent signed.

is authorized to act on your behalf. If all tax types, write

“ALL”.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4