8845

Indian Employment Credit

OMB No. 1545-1417

2011

Form

Department of the Treasury

Attachment

Attach to your tax return.

113

▶

Internal Revenue Service

Sequence No.

Name(s) shown on return

Identifying number

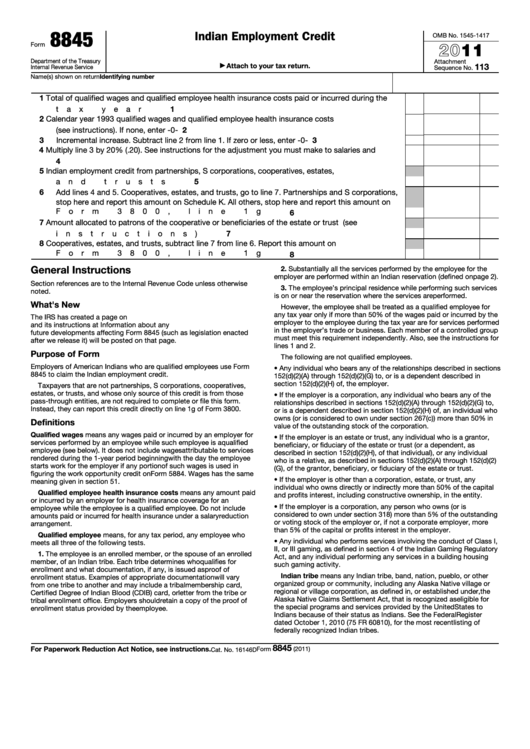

1

Total of qualified wages and qualified employee health insurance costs paid or incurred during the

tax year

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2

Calendar year 1993 qualified wages and qualified employee health insurance costs

(see instructions). If none, enter -0-

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

3

Incremental increase. Subtract line 2 from line 1. If zero or less, enter -0- .

.

.

.

.

.

.

.

.

3

4

Multiply line 3 by 20% (.20). See instructions for the adjustment you must make to salaries and

wages .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5

Indian employment credit from partnerships, S corporations, cooperatives, estates,

5

and trusts .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Add lines 4 and 5. Cooperatives, estates, and trusts, go to line 7. Partnerships and S corporations,

stop here and report this amount on Schedule K. All others, stop here and report this amount on

Form 3800, line 1g .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust (see

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Cooperatives, estates, and trusts, subtract line 7 from line 6. Report this amount on

Form 3800, line 1g .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

General Instructions

2. Substantially all the services performed by the employee for the

employer are performed within an Indian reservation (defined on page 2).

Section references are to the Internal Revenue Code unless otherwise

3. The employee’s principal residence while performing such services

noted.

is on or near the reservation where the services are performed.

What's New

However, the employee shall be treated as a qualified employee for

any tax year only if more than 50% of the wages paid or incurred by the

The IRS has created a page on IRS.gov for information about Form 8845

employer to the employee during the tax year are for services performed

and its instructions at Information about any

in the employer’s trade or business. Each member of a controlled group

future developments affecting Form 8845 (such as legislation enacted

must meet this requirement independently. Also, see the instructions for

after we release it) will be posted on that page.

lines 1 and 2.

Purpose of Form

The following are not qualified employees.

Employers of American Indians who are qualified employees use Form

• Any individual who bears any of the relationships described in sections

8845 to claim the Indian employment credit.

152(d)(2)(A) through 152(d)(2)(G) to, or is a dependent described in

section 152(d)(2)(H) of, the employer.

Taxpayers that are not partnerships, S corporations, cooperatives,

estates, or trusts, and whose only source of this credit is from those

• If the employer is a corporation, any individual who bears any of the

pass-through entities, are not required to complete or file this form.

relationships described in sections 152(d)(2)(A) through 152(d)(2)(G) to,

Instead, they can report this credit directly on line 1g of Form 3800.

or is a dependent described in section 152(d)(2)(H) of, an individual who

owns (or is considered to own under section 267(c)) more than 50% in

Definitions

value of the outstanding stock of the corporation.

Qualified wages means any wages paid or incurred by an employer for

• If the employer is an estate or trust, any individual who is a grantor,

services performed by an employee while such employee is a qualified

beneficiary, or fiduciary of the estate or trust (or a dependent, as

employee (see below). It does not include wages attributable to services

described in section 152(d)(2)(H), of that individual), or any individual

rendered during the 1-year period beginning with the day the employee

who is a relative, as described in sections 152(d)(2)(A) through 152(d)(2)

starts work for the employer if any portion of such wages is used in

(G), of the grantor, beneficiary, or fiduciary of the estate or trust.

figuring the work opportunity credit on Form 5884. Wages has the same

• If the employer is other than a corporation, estate, or trust, any

meaning given in section 51.

individual who owns directly or indirectly more than 50% of the capital

Qualified employee health insurance costs means any amount paid

and profits interest, including constructive ownership, in the entity.

or incurred by an employer for health insurance coverage for an

• If the employer is a corporation, any person who owns (or is

employee while the employee is a qualified employee. Do not include

considered to own under section 318) more than 5% of the outstanding

amounts paid or incurred for health insurance under a salary reduction

or voting stock of the employer or, if not a corporate employer, more

arrangement.

than 5% of the capital or profits interest in the employer.

Qualified employee means, for any tax period, any employee who

• Any individual who performs services involving the conduct of Class I,

meets all three of the following tests.

II, or III gaming, as defined in section 4 of the Indian Gaming Regulatory

1. The employee is an enrolled member, or the spouse of an enrolled

Act, and any individual performing any services in a building housing

member, of an Indian tribe. Each tribe determines who qualifies for

such gaming activity.

enrollment and what documentation, if any, is issued as proof of

Indian tribe means any Indian tribe, band, nation, pueblo, or other

enrollment status. Examples of appropriate documentation will vary

organized group or community, including any Alaska Native village or

from one tribe to another and may include a tribal membership card,

regional or village corporation, as defined in, or established under, the

Certified Degree of Indian Blood (CDIB) card, or letter from the tribe or

Alaska Native Claims Settlement Act, that is recognized as eligible for

tribal enrollment office. Employers should retain a copy of the proof of

the special programs and services provided by the United States to

enrollment status provided by the employee.

Indians because of their status as Indians. See the Federal Register

dated October 1, 2010 (75 FR 60810), for the most recent listing of

federally recognized Indian tribes.

8845

For Paperwork Reduction Act Notice, see instructions.

Form

(2011)

Cat. No. 16146D

1

1 2

2