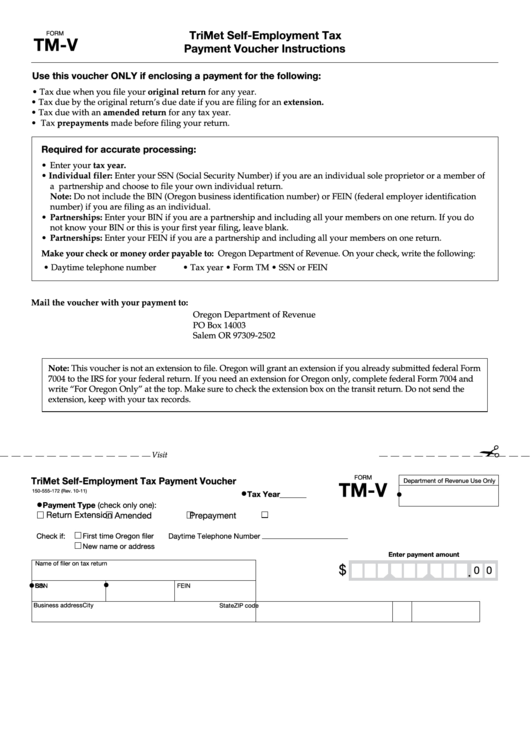

TriMet Self-Employment Tax

FORM

TM-V

Payment Voucher Instructions

Use this voucher ONLY if enclosing a payment for the following:

• Tax due when you file your original return for any year.

• Tax due by the original return’s due date if you are filing for an extension.

• Tax due with an amended return for any tax year.

• Tax prepayments made before filing your return.

Required for accurate processing:

• Enter your tax year.

• Individual filer: Enter your SSN (Social Security Number) if you are an individual sole proprietor or a member of

a partnership and choose to file your own individual return.

Note: Do not include the BIN (Oregon business identification number) or FEIN (federal employer identification

number) if you are filing as an individual.

• Partnerships: Enter your BIN if you are a partnership and including all your members on one return. If you do

not know your BIN or this is your first year filing, leave blank.

• Partnerships: Enter your FEIN if you are a partnership and including all your members on one return.

Make your check or money order payable to: Oregon Department of Revenue. On your check, write the following:

• Daytime telephone number

• Tax year

• Form TM

• SSN or FEIN

Mail the voucher with your payment to:

Oregon Department of Revenue

PO Box 14003

Salem OR 97309-2502

Note: This voucher is not an extension to file. Oregon will grant an extension if you already submitted federal Form

7004 to the IRS for your federal return. If you need an extension for Oregon only, complete federal Form 7004 and

write “For Oregon Only” at the top. Make sure to check the extension box on the transit return. Do not send the

extension, keep with your tax records.

Clear Form

✁

Visit to print more vouchers

FORM

TriMet Self-Employment Tax Payment Voucher

Department of Revenue Use Only

TM-V

•

•

150-555-172 (Rev. 10-11)

Tax Year

•

Payment Type (check only one):

Return

Extension

Amended

Prepayment

Check if:

First time Oregon filer

Daytime Telephone Number

New name or address

Enter payment amount

Name of filer on tax return

$

0 0

.

•

•

SSN

BIN

FEIN

Business address

City

State ZIP code

1

1