Form Rpd-41137 - Registration Update For Oil And Gas Taxes Page 2

ADVERTISEMENT

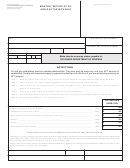

REGISTRATION UPDATE FOR OIL AND GAS TAXES

INSTRUCTIONS FOR FORM RPD-41137

Use this form to notify the Taxation and Revenue Department when you:

Want to apply for an OGRID (Oil and Gas Reporting Identification) number.

Change your mailing address; or

Wish to cancel an OGRID (Oil and Gas Reporting Identification) number.

Wish to deactivate an (OGRID) role(s).

Enter your OGRID Number in the top center box. Fill in the current information (as it appears on Taxation and

Revenue Department records before the change is made) in the box marked CURRENT INFORMATION.

In the box marked CHANGE OF ADDRESS, indicate the role(s) which the update is being submitted (Natural Gas

Processors Tax Filer, Oil and Gas Taxes Filer or a Master Operator) by checking the appropriate boxes. Your

update will be recorded for all roles checked. If you have more than one role, but are updating information for only

one, check only that one box.

ROLE DEFINITIONS:

Natural Gas Processors Tax (NGPT) Filer: An interest owner / plant processor who reports and remits the natural

gas processors tax.

Oil and Gas Taxes (OGT) Filer: An Operator/Working Interest Owner or a Purchaser who reports and remits oil

and gas production taxes on their own behalf and/or on behalf of other working interest owner(s).

Master Operator (Equipment Tax): An Operator of a well completion who is the party responsible for remitting

payment on the annual ad valorem equipment tax.

Example: OGRID 99999 is both a Master Operator and an Oil and Gas Taxes (OGT) Filer who pays both the oil

and gas production taxes and the annual ad valorem equipment tax. OGRID 99999 would like to change their

address for the annual ad valorem equipment tax assessment but would like the address for the production taxes

to remain the same. OGRID 99999 would check the Master Operator box only.

Indicate your change of address by entering the NEW information as you want it to appear on your Taxation and

Revenue Department records.

This Registration Update must be signed. New Mexico statutes and regulations require that all notices, returns or

applications to be made by the taxpayer have a correct mailing address and it is the taxpayers

responsibility to notify the Department of any change.

Mail or deliver the completed form to:

New Mexico Taxation and Revenue Department

Oil and Gas Bureau

1200 South St. Francis Drive

P. O. Box 2308

Santa Fe, NM 87504-2308

Telephone: (505) 827-0808

- 28 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2