Reset Form

Print Form

Form

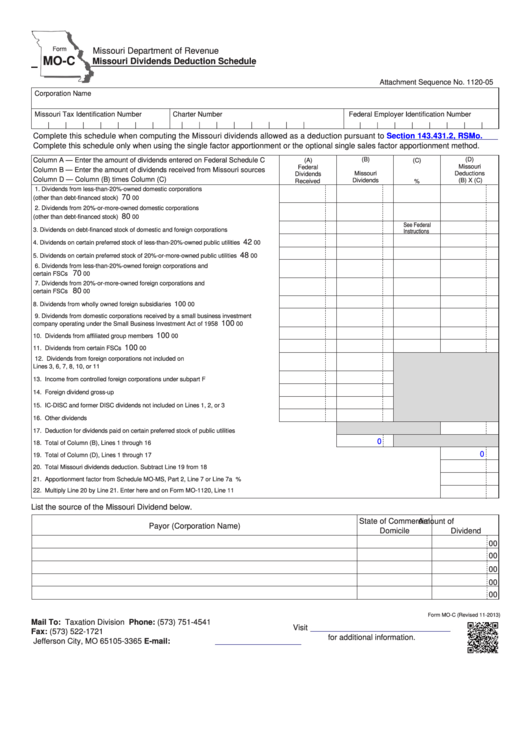

Missouri Department of Revenue

MO-C

Missouri Dividends Deduction Schedule

Attachment Sequence No. 1120-05

Corporation Name

Missouri Tax Identification Number

Charter Number

Federal Employer Identification Number

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete this schedule when computing the Missouri dividends allowed as a deduction pursuant to

Section 143.431.2, RSMo.

Complete this schedule only when using the single factor apportionment or the optional single sales factor apportionment method.

Column A — Enter the amount of dividends entered on Federal Schedule C

(B)

(D)

(A)

(C)

Missouri

Federal

Column B — Enter the amount of dividends received from Missouri sources

Missouri

Deductions

Dividends

Column D — Column (B) times Column (C)

Dividends

(B) X (C)

Received

%

1. Dividends from less-than-20%-owned domestic corporations

70

(other than debt-financed stock) .......................................................................................

00

00

00

2. Dividends from 20%-or-more-owned domestic corporations

80

(other than debt-financed stock) .......................................................................................

00

00

00

See Federal

3. Dividends on debt-financed stock of domestic and foreign corporations .........................

00

00

Instructions

00

42

4. Dividends on certain preferred stock of less-than-20%-owned public utilities ..................

00

00

00

48

5. Dividends on certain preferred stock of 20%-or-more-owned public utilities ....................

00

00

00

6. Dividends from less-than-20%-owned foreign corporations and

70

certain FSCs ....................................................................................................................

00

00

00

7. Dividends from 20%-or-more-owned foreign corporations and

80

certain FSCs ...................................................................................................................

00

00

00

100

8. Dividends from wholly owned foreign subsidiaries .............................................................

00

00

00

9. Dividends from domestic corporations received by a small business investment

100

company operating under the Small Business Investment Act of 1958 ...........................

00

00

00

100

10. Dividends from affiliated group members .........................................................................

00

00

00

100

11. Dividends from certain FSCs ............................................................................................

00

00

00

12. Dividends from foreign corporations not included on

Lines 3, 6, 7, 8, 10, or 11 ..................................................................................................

00

00

13. Income from controlled foreign corporations under subpart F ..........................................

00

00

14. Foreign dividend gross-up ................................................................................................

00

00

15. IC-DISC and former DISC dividends not included on Lines 1, 2, or 3 .............................

00

00

16. Other dividends ................................................................................................................

00

00

17. Deduction for dividends paid on certain preferred stock of public utilities .........................................................

00

0

18. Total of Column (B), Lines 1 through 16 ............................................................................................................

00

0

19. Total of Column (D), Lines 1 through 17 .........................................................................................................................................................................

00

20. Total Missouri dividends deduction. Subtract Line 19 from 18 ........................................................................................................................................

00

21. Apportionment factor from Schedule MO-MS, Part 2, Line 7 or Line 7a .........................................................................................................................

%

22. Multiply Line 20 by Line 21. Enter here and on Form MO-1120, Line 11 ........................................................................................................................

00

List the source of the Missouri Dividend below.

State of Commercial

Amount of

Payor (Corporation Name)

Domicile

Dividend

00

00

00

00

00

Form MO-C (Revised 11-2013)

Mail To:

Taxation Division

Phone: (573) 751-4541

Visit

P.O. Box 3365

Fax: (573) 522-1721

for additional information.

Jefferson City, MO 65105-3365

E-mail:

corporate@dor.mo.gov

1

1