3

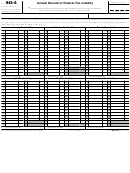

Form 943-A (Rev. 2-2015)

Page

Future Developments

Make sure you have checked the appropriate box

below line 16 of Form 943 to show that you are a

TIP

For the latest information about developments related to Form 943-A

semiweekly schedule depositor.

and its instructions, such as legislation enacted after they were

published, go to

Here are some additional examples.

Reminders

• Employer A is a semiweekly schedule depositor. Employer A

accumulated a federal tax liability of $3,000 on its January 11 and

Reporting prior period adjustments. Prior period adjustments are

January 25 paydays. In the January column, Employer A must enter

reported on Form 943-X, Adjusted Employer’s Annual Federal Tax

$3,000 on lines 11 and 25.

Return for Agricultural Employees or Claim for Refund, and are not

• Employer B is a semiweekly schedule depositor who paid wages

taken into account when figuring the tax liability for the current year.

in October, November, and December on the last day of the month.

When you file Form 943-A with your Form 943, do not change

On December 24, 2014, Employer B also paid its employees

your tax liability by adjustments reported on any Forms 943-X.

year-end bonuses (subject to employment taxes). Because

Amended Form 943-A. If you have been assessed a

Employer B is a semiweekly schedule depositor, Employer B must

failure-to-deposit (FTD) penalty, you may be able to file an amended

record employment tax liabilities on Form 943-A.

Form 943-A. See Correcting Previously Reported Tax Liability, later.

Month

Lines for dates wages were paid

General Instructions

October

line 31 (payday, last day of the month)

Purpose of form. Use Form 943-A to report your tax liability

(federal income tax withheld plus both employee and employer

November

line 30 (payday, last day of the month)

social security and Medicare taxes). Do not show federal tax

lines 24 (bonus paid) + 31 (payday, last day of the

December

deposits here.

month)

Do not report taxes on wages paid to nonfarm workers on this

form. Taxes on wages paid to nonfarm workers are reported on

• Employer C is a new business and monthly schedule depositor

Form 941/941-SS, Employer’s QUARTERLY Federal Tax Return, or

for 2014. Employer C pays wages every Friday. Employer C

Form 944, Employer’s ANNUAL Federal Tax Return. Do not attach

incurred a $2,000 employment tax liability on 10/10/14. Employer C

Form 943-A to your Form 941/941-SS or Form 944. Instead, use

incurred a $110,000 tax liability on 10/17/14 and on every

Schedule B (Form 941) or Form 945-A, Annual Record of Federal

subsequent Friday during 2014. Under the deposit rules, employers

Tax Liability (with Form 944).

become semiweekly schedule depositors on the day after any

Caution. IRS uses Form 943-A to determine if you have timely

day they accumulate $100,000 or more of tax liability in a deposit

deposited your Form 943 tax liabilities. If you are a semiweekly

period.

schedule depositor and you do not properly complete and file

Because Employer C accumulated $112,000 in tax liability on

Form 943-A with Form 943, the IRS may propose an “averaged”

10/17/14, Employer C became a semiweekly schedule depositor

FTD penalty. See Deposit Penalties in section 7 of Pub. 51 (Circular

on the next day and must complete Form 943-A and file it with

A), Agricultural Employer's Tax Guide, for more information.

Form 943.

Who must file. Semiweekly schedule depositors must complete

Month

Lines for dates wages were paid

Amount to record

and file Form 943-A with Form 943. Monthly schedule depositors

who accumulate $100,000 or more of tax liability during any month

become semiweekly schedule depositors on the next day and must

October

line 10

$2,000

also complete and file Form 943-A. Do not file Form 943-A if you

October

lines 17, 24, 31

$110,000

were a monthly schedule depositor for the entire year or if your total

taxes after adjustments for the year (Form 943, line 11) are less than

November

lines 7, 14, 21, 28

$110,000

$2,500.

December

lines 5, 12, 19, 26

$110,000

Note. If you use Form 943-A, do not complete Form 943, line 17.

See Depositing Taxes in Pub. 51 (Circular A) for more information.

When to file. File Form 943-A with your Form 943 every year when

Form 943 is due. See the Instructions for Form 943 for due dates.

Correcting Previously Reported Tax Liability

Specific Instructions

Semiweekly schedule depositors. If you have been assessed an

FTD penalty and you made an error on Form 943-A and the

Enter your business information. Carefully enter your employer

correction will not change the total liability you reported on Form

identification number (EIN) and name at the top of the form. Make

943-A, you may be able to reduce your penalty by filing an

sure that they exactly match the name of your business and the EIN

amended Form 943-A.

that the IRS assigned to your business and also agree with the

Example. You reported a tax liability of $3,000 on January 1.

name and EIN shown on the attached Form 943 or Form 943-X.

However, the liability was actually for March. Prepare an amended

Calendar year. Enter the calendar year of the Form 943 or Form

Form 943-A showing the $3,000 liability on March 1. Also, you must

943-X to which Form 943-A is attached.

enter the liabilities previously reported for the year that did not

change. Write “Amended” at the top of Form 943-A. The IRS will

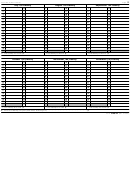

Enter your tax liability by month. Enter your tax liabilities in the

refigure the penalty and notify you of any change in the penalty.

spaces that correspond to the dates you paid wages to your

employees, not the date payroll deposits were made. The total tax

Monthly schedule depositors. You can file Form 943-A if you have

liability for the year (line M) must equal total taxes after adjustments

been assessed an FTD penalty and you made an error on the

on Form 943 (line 11). Report your tax liabilities on this form

monthly tax liability section of Form 943. When completing Form

corresponding to the dates of each wage payment, not to when

943-A for this situation, only enter the monthly totals. The daily

payroll liabilities are accrued. Enter the monthly totals on lines A, B,

entries are not required.

C, D, E, F, G, H, I, J, K, and L. Enter the total for the year on line M.

Where to file. File your amended Form 943-A, or, for monthly

For example, if your payroll period ended on December 31, 2013,

schedule depositors, your original Form 943-A at the address

and you paid the wages for that period on January 7, 2014, you

provided in the penalty notice you received. If you are filing an

would:

amended Form 943-A, you do not have to submit your original

Form 943-A.

• Go to January, and

• Enter your tax liability on line 7 (because line 7 represents the

seventh day of the month).

1

1 2

2 3

3 4

4