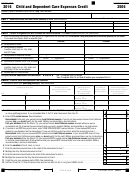

Form 2441-M Instructions

Am I eligible to claim the child and dependent

costs as clothing, education, medical treatment,

care expense deduction?

vacations, life insurance, or transportation.

You are eligible to take this deduction if you paid

If I care for my own child in my licensed day-

expenses for household and dependent care

care do I qualify for this deduction?

services necessary for gainful employment in

You qualify for this deduction if you are a licensed

order to maintain a household that includes, as a

and registered day-care provider who operates a

member of the household, one or more qualifying

family day-care home or a group day-care home

individuals.

and care for your own child and at least one

A qualified individual is a:

unrelated child. The amount of dependent care

● dependent under the age of 15 that you may

expenses that you can claim for your own child

claim as a dependent on your income tax

cannot be greater than the amount you charge for

return; or

the care of an unrelated child. Your expenses are

equal to the expenses that you charge for a child

● dependent who, regardless of age, is unable

of the same age and for the same number of

to care for himself or herself because of a

hours of care regardless of whether you actually

physical or mental illness; or

paid these expenses for the care of your child or

● spouse who is unable to care for himself

not.

or herself because of a physical or mental

What if the expense qualifies as both an

illness.

employment-related expense and a medical

How do I determine if I maintain a household

expense?

that entitles me to claim this deduction?

You may treat it as either an employment-related

You can qualify as maintaining a household

expense or a medical expense as long as you do

for the tax year if you furnish over half the cost

not deduct it twice.

of maintaining the household for the tax year.

If you treat the deduction as a medical expense,

If you are married, both you and your spouse

the part of that expense that is not deductible

are required to provide over half the cost of

because of the 7.5% medical deduction limitation

maintaining the household.

cannot be used as part of your employment-

The cost of maintaining a household includes, but

related expenses.

is not limited to, expenses paid for property taxes,

Administrative Rules of Montana: 42.15.427

property insurance, mortgage interest, rent,

utilities, upkeep, repairs, and food consumed

Questions? Please call us toll free at

(866) 859-2254 (in Helena, 444-6900).

on the premises. Expenses do not include such

1

1 2

2