Form Dr-5 - Application For Consumer'S Certificate Of Exemption

ADVERTISEMENT

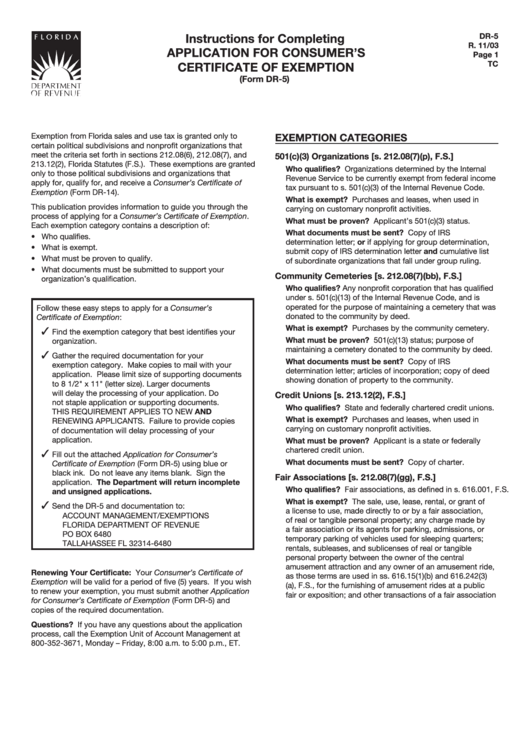

Instructions for Completing

Dr-5

r. 11/03

ApplICAtIon for Consumer’s

page 1

tC

CertIfICAte of exemptIon

(form Dr-5)

Exemption from Florida sales and use tax is granted only to

exemptIon CAteGorIes

certain political subdivisions and nonprofit organizations that

meet the criteria set forth in sections 212.08(6), 212.08(7), and

501(c)(3) organizations [s. 212.08(7)(p), f.s.]

213.12(2), Florida Statutes (F.S.). These exemptions are granted

Who qualifies? organizations determined by the internal

only to those political subdivisions and organizations that

Revenue Service to be currently exempt from federal income

apply for, qualify for, and receive a Consumer’s Certificate of

tax pursuant to s. 501(c)(3) of the internal Revenue code.

Exemption (Form DR-14).

What is exempt? Purchases and leases, when used in

This publication provides information to guide you through the

carrying on customary nonprofit activities.

process of applying for a Consumer’s Certificate of Exemption.

What must be proven? applicant’s 501(c)(3) status.

Each exemption category contains a description of:

What documents must be sent? copy of iRS

• Who qualifies.

determination letter; or if applying for group determination,

• What is exempt.

submit copy of iRS determination letter and cumulative list

• What must be proven to qualify.

of subordinate organizations that fall under group ruling.

• What documents must be submitted to support your

Community Cemeteries [s. 212.08(7)(bb), f.s.]

organization’s qualification.

Who qualifies? any nonprofit corporation that has qualified

under s. 501(c)(13) of the internal Revenue code, and is

operated for the purpose of maintaining a cemetery that was

Follow these easy steps to apply for a Consumer’s

donated to the community by deed.

Certificate of Exemption:

What is exempt? Purchases by the community cemetery.

✓

Find the exemption category that best identifies your

What must be proven? 501(c)(13) status; purpose of

organization.

maintaining a cemetery donated to the community by deed.

✓

Gather the required documentation for your

What documents must be sent? copy of iRS

exemption category. Make copies to mail with your

determination letter; articles of incorporation; copy of deed

application. Please limit size of supporting documents

showing donation of property to the community.

to 8 1/2" x 11" (letter size). Larger documents

will delay the processing of your application. Do

Credit unions [s. 213.12(2), f.s.]

not staple application or supporting documents.

Who qualifies? State and federally chartered credit unions.

ThiS REquiREMEnT aPPLiES To nEW AnD

What is exempt? Purchases and leases, when used in

REnEWinG aPPLicanTS. Failure to provide copies

carrying on customary nonprofit activities.

of documentation will delay processing of your

application.

What must be proven? applicant is a state or federally

chartered credit union.

✓

Fill out the attached Application for Consumer’s

What documents must be sent? copy of charter.

Certificate of Exemption (Form DR-5) using blue or

black ink. Do not leave any items blank. Sign the

fair Associations [s. 212.08(7)(gg), f.s.]

application. the Department will return incomplete

Who qualifies? Fair associations, as defined in s. 616.001, F.S.

and unsigned applications.

What is exempt? The sale, use, lease, rental, or grant of

✓

Send the DR-5 and documentation to:

a license to use, made directly to or by a fair association,

accounT ManaGEMEnT/EXEMPTionS

of real or tangible personal property; any charge made by

FLoRiDa DEPaRTMEnT oF REVEnuE

a fair association or its agents for parking, admissions, or

Po BoX 6480

temporary parking of vehicles used for sleeping quarters;

TaLLahaSSEE FL 32314-6480

rentals, subleases, and sublicenses of real or tangible

personal property between the owner of the central

amusement attraction and any owner of an amusement ride,

renewing Your Certificate: Your Consumer’s Certificate of

as those terms are used in ss. 616.15(1)(b) and 616.242(3)

Exemption will be valid for a period of five (5) years. if you wish

(a), F.S., for the furnishing of amusement rides at a public

to renew your exemption, you must submit another Application

fair or exposition; and other transactions of a fair association

for Consumer’s Certificate of Exemption (Form DR-5) and

copies of the required documentation.

Questions? if you have any questions about the application

process, call the Exemption unit of account Management at

800-352-3671, Monday – Friday, 8:00 a.m. to 5:00 p.m., ET.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4