Form 55a100 - Coal Severance Tax Return

ADVERTISEMENT

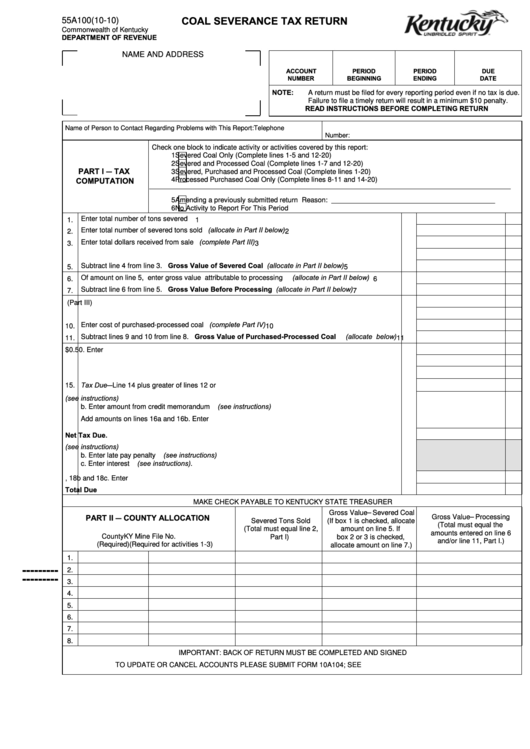

COAL SEVERANCE TAX RETURN

55A100(10-10)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

NAME AND ADDRESS

ACCOUNT

PERIOD

PERIOD

DUE

NUMBER

BEGINNING

ENDING

DATE

NOTE:

A return must be filed for every reporting period even if no tax is due.

Failure to file a timely return will result in a minimum $10 penalty.

READ INSTRUCTIONS BEFORE COMPLETING RETURN

Name of Person to Contact Regarding Problems with This Report:

Telephone

Number:

Check one block to indicate activity or activities covered by this report:

1

Severed Coal Only (Complete lines 1-5 and 12-20)

2

Severed and Processed Coal (Complete lines 1-7 and 12-20)

PART I — TAX

3

Severed, Purchased and Processed Coal (Complete lines 1-20)

COMPUTATION

4

Processed Purchased Coal Only (Complete lines 8-11 and 14-20)

5

Amending a previously submitted return Reason: __________________________________________

6

No Activity to Report For This Period

Enter total number of tons severed ........................... .................................................................................... 1

1.

Enter total number of severed tons sold (allocate in Part II below) ................................................................

2.

2

Enter total dollars received from sale (complete Part III) .............................................................................. 3

3.

4.

Enter transportation expense applicable to severed coal ............................................................................... 4

Subtract line 4 from line 3. Gross Value of Severed Coal (allocate in Part II below) ...............................

5.

5

Of amount on line 5, enter gross value attributable to processing (allocate in Part II below) ..................... 6

6.

Subtract line 6 from line 5. Gross Value Before Processing (allocate in Part II below) ...........................

7.

7

8.

Enter total dollars received from resale of purchased-processed coal (Part III) . ..........................................

8

9.

Enter transportation expense applicable to purchased-processed coal ........................................................

9

10. Enter cost of purchased-processed coal (complete Part IV) ......................................................................

10

11. Subtract lines 9 and 10 from line 8. Gross Value of Purchased-Processed Coal (allocate below)

11

12. Multiply amount on line 2 by $0.50. Enter result .......................................................................................... 12

13. Multiply amount on line 5 by 0.045. Enter result .......................................................................................... 13

14. Multiply amount on line 11 by 0.045. Enter result ........................................................................................ 14

15. Tax Due— Line 14 plus greater of lines 12 or 13 ......................................................................................... 15

16. a. Enter total thin seam credit from Part V. (see instructions) ............

b. Enter amount from credit memorandum (see instructions) ............

Add amounts on lines 16a and 16b. Enter Total........................................................................................... 16

17. Deduct line 16 from line 15. Net Tax Due. ................................................................................................. 17

18. a. Enter late filing penalty (see instructions) .................................

b. Enter late pay penalty (see instructions) ..................................

c. Enter interest (see instructions) ...............................................

19. Add amounts on lines 18a, 18b and 18c. Enter Total ................................................................................. 19

20. Add lines 17 and 19. Total Due ................................................................................................................. 20

MAKE CHECK PAYABLE TO KENTUCKY STATE TREASURER

Gross Value–Severed Coal

PART II — COUNTY ALLOCATION

Gross Value–Processing

Severed Tons Sold

(If box 1 is checked, allocate

(Total must equal the

(Total must equal line 2,

amount on line 5. If

amounts entered on line 6

County

KY Mine File No.

Part I)

box 2 or 3 is checked,

and/or line 11, Part I.)

(Required)

(Required for activities 1-3)

allocate amount on line 7.)

1.

---------

2.

---------

3.

4.

5.

6.

7.

8.

IMPORTANT: BACK OF RETURN MUST BE COMPLETED AND SIGNED

TO UPDATE OR CANCEL ACCOUNTS PLEASE SUBMIT FORM 10A104; SEE revenue.ky.gov/forms/curyrfrms.htm.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4