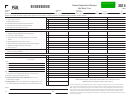

2014

140007PB

Schedule

Alabama Department of Revenue

Reset Schedule Only

PAB

Add-Back Form

ADOR

(Form 65, 20S)

TAXPAYER

TAXPAYER

FOR THE

, 20

through

, 20

NAME:

FEIN:

TAX PERIOD

A column must be completed for each recipient related member. Attach additional pages as needed and enter the totals of Lines 4 and Lines 11 for all related members from all pages on Page 1, Line 12 and 13.

Related Member 1

Related Member 2

Related Member 3

Related Member 4

Recipient related member who received interest/intangible income from the taxpayer:

1a

1 a. Recipient related member FEIN. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1b

b. Recipient related member name. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 List the intangible expense amounts paid to the recipient related member.. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3 List the interest expense amounts paid to the recipient related member.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4 Total intangible/interest expenses paid (total lines 2 and 3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

To determine the exempt amount of intangible/interest expense, complete the applicable section(s) below.

5 Exemption related to §40-18-35(b)(1) and §40-18-24(b):

5a

a. Jurisdiction(s) where recipient related member income is “subject to tax”: . . . . . . . . . . . . . . . . . . . . . . . . . .

5b

b. Amount of Line 4 expense not added back. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c. Recipient related member’s corresponding intangible/interest income allocated to

5c

jurisdiction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5d

d. Adjusted intangible/interest amount (Line 5b minus Line 5c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5e

%

%

%

%

e. Recipient related member’s total apportionment percentage in the above jurisdiction(s). . . . . . . . . . . . . . .

5f

f. Adjusted interest/intangible amount (multiply Line 5d by Line 5e). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5g

g. Add Line 5c and Line 5f. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Exemption related to §40-18-35(b)(2), §40-18-35(b)(4), §40-18-24(d) and §40-18-24(f)

6

– Amount of Line 4 expense not added back. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NOTE: For Section 7, 8, 9, and 10 the receipts of a disregarded entity/subchapter K entity, which may be a related entity in and unto itself, may not be combined with receipts of its owner for purposes of this schedule.

7

7 Exemption related to §40-18-35(b)(3) and §40-18-24(e) – Amount of Line 4 expense not added back. . . . .

8a

8 Recipient related member receipts by category:

a. Intangible receipts . . . . . . . . . . . . . . . . . . . . . . . .

8b

b. lnterest receipts . . . . . . . . . . . . . . . . . . . . . . . . . .

9a

9 a.

9b

b.

9c

c.

9d

d.

9e

e.

10a

10 a. If either Lines 8a or 8b are greater than Lines 9a, 9b, 9c, 9d or 9e, enter zero. . . . . . . . . . . . . . . . . . . . . . .

10b

b. If Lines 9a, 9b, 9c, 9d or 9e are greater than Lines 8a or 8b, enter amount from Line 7. . . . . . . . . . . . . . .

11

11 Exempt Amount. Enter the greater of Lines 5g, 6, 10a or 10b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

FOR RECIPIENT RELATED MEMBERS WHO RECEIVED INTEREST/INTANGIBLE INCOME FROM THE TAXPAYER, PLEASE ATTACH ADDITIONAL SCHEDULES PAB. (ONLY USE THIS PAGE FOR ADDITIONAL MEMBERS)

Page

of

THIS FORM MUST BE ATTACHED TO FORM 65 or 20S.

1

1 2

2