Form Sc 1120 - South Carolina 'C' Corporation Income Tax Return Page 4

ADVERTISEMENT

SC1120

Page 4

ONLY MULTI-STATE CORPORATIONS MUST COMPLETE SCHEDULES E, F, G, AND H

SCHEDULE E

COMPUTATION OF LICENSE FEE OF MULTI-STATE CORPORATIONS

1. Total Capital and Paid-in-Surplus at end of Year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

2. SC PROPORTION: (line 1 X ratio from Schedule H-1, H-2 or H-3, as appropriate). Also enter on line 20, Part II . . . $

SCHEDULE F

INCOME SUBJECT TO DIRECT ALLOCATION

Less:

Net Amounts

Net Amounts

Gross

Related

Allocated Directly

Allocated

Amounts

Expenses

to SC and Other States

Directly to SC

1

2

3

4

1. Interest not connected with business

2. Dividends received

3. Rents

4. Gains/losses on real property

5. Gains/losses on intangible pers. prop.

6. Investment income directly allocated

7. TOTAL INCOME DIRECTLY ALLOCATED

8. INCOME DIRECTLY ALLOCATED TO SC

SCHEDULE G

COMPUTATION OF TAXABLE INCOME OF MULTI-STATE CORPORATIONS

1.

1. Total net income as reconciled. Enter amount from line 3, Page 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Less: Income subject to direct allocation to SC and other states from Schedule F, line 7 . . . . . . . . . . . . . . .

2.

3. Total net income subject to apportionment (line 1 less line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4.

4. Multiply amount on line 3 by appropriate ratio from Schedule H-1, H-2, or H-3 and enter result here . . . . . .

5. Add: Income subject to direct allocation to SC from Schedule F, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Total SC Net Income (sum of lines 4 and 5 above) also enter on line 4, Part 1 of Page 1 . . . . . . . . . . . . . . .

6.

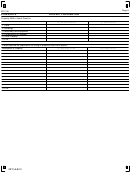

SCHEDULE H-1

COMPUTATION OF SALES RATIO

Amount

Ratio

1. Total Sales Within South Carolina (see instructions)

2. Total Sales Everywhere (see instructions)

%

3. Sales Ratio (line 1 ÷ line 2)

Note: If there are no sales anywhere:

Enter 100% on Line 3, if South Carolina is the principal place of business OR

Enter 0% on Line 3, if principal place of business is outside South Carolina.

SCHEDULE H-2

COMPUTATION OF GROSS RECEIPTS RATIO

Amount

Ratio

1. South Carolina Gross Receipts

<

>

2. Amounts Allocated to South Carolina on Schedule F

3. South Carolina Adjusted Gross Receipts (line 1 – line 2)

4. Total Gross Receipts

<

>

5.

Total Amounts Allocated on Schedule F

6.

Total Adjusted Gross Receipts (line 4 – line 5)

7.

Gross Receipts Ratio (line 3 ÷ line 6)

%

SCHEDULE H-3

COMPUTATION OF RATIO FOR SECTION 12-6-2310 COMPANIES

Amount

Ratio

1. Total Within South Carolina (see instructions)

2. Total Everywhere

3. Taxable Ratio (line 1 ÷ line 2)

%

30914022

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8