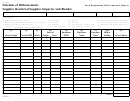

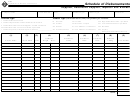

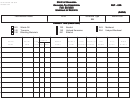

Form 4124, Page 2

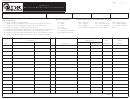

Instructions for Form 4124, Blender Schedule of Disbursements

General Instructions -

Tax is due upon removal, importation or other taxable event and must be included in the report for the month in which the transaction takes place.

Schedule Types - Check the appropriate box on page 1.

5

Gallons of taxable fuel removed, sold or imported. Do not include gallons reported on other disbursement schedules.

5C

Gallons of aviation fuel sold to Aviation Fuel Registrants for resale.

5F

Gallons of dyed diesel/dyed biodiesel fuel sold/used for taxable purposes with Michigan tax collected.

5Z

Gallons sold for Racing Fuel - Michigan tax collected.

6F

Gallons of dyed diesel/dyed biodiesel fuel sold or removed for tax-exempt purposes.

6Z

Gallons sold for racing fuel - Michigan tax not collected.

7A

Gallons exported by supplier or sold for export - Destination state tax collected or accrued. (Michigan tax was not collected.) Attach separate schedule for each

state/province/country. Licensed Suppliers and Exporters only.

Gallons sold for export with Michigan tax collected. Attach separate schedule for each state/province/country. Submit two copies of each. Licensed Suppliers and

7B

Exporters only.

Gallons sold tax-free to U.S. government located in Michigan.

8

Gallons sold tax-free to state and/or local government in Michigan, including public schools. Gasoline, ethanol blends, undyed diesel, undyed biodiesel, and dyed

9

biodiesel only. Does not apply to aviation fuel.

Gallons of Foreign Trade Zone aviation fuel disbursed. Licensed Suppliers only.

10F

Gallons sold tax-free to non-profit, private, parochial or denominational school, college or university, used in buses for transportation of students for authorized functions.

10G

Gallons of gasoline, ethanol, or gasoline-ethanol blends sold tax-free to fuel feedstock users.

10M

Product Codes - Enter the appropriate code on page 1. See the Blender Monthly Tax Return instructions or Treasury's Web site for a list of product

codes.

Column Instructions

Column (1) & (2):

Carrier - Enter the name and Federal Employer ID Number (FEIN) of the company that transports the product.

Column (3):

Mode of Transport - Enter the mode of transport. Use one of the following:

J = Truck

R = Rail

B = Barge

S = Ship (Great Lakes or ocean marine vessel)

RT= Removal from terminal (other than by truck or rail for sale or consumption)

Column (4):

Point of Origin - Enter the location from which the product originated.

Column (5)

Point of Desination - Enter the location to which the product was delivered. If delivered into tax-free terminal storage (Schedule 10F), the Terminal

Control Number must be reported.

Column (6) & (7):

Sold to - Enter name of purchaser and FEIN.

Column (8):

Date Shipped - Enter the date the product was shipped.

Column (9):

Document Number - Enter the bill of lading number.

Column (10):

Net Gallons - Enter the net amount of gallons disbursed.

Column (11):

Gross Gallons - Enter the gross amount of gallons disbursed.

Column (12):

Billed Gallons - Enter the number of gallons to be billed to the customer.

1

1 2

2