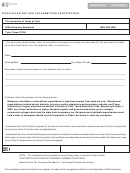

Form 01-925 (Back)(Rev.11-11/2)

Do Not Qualify

Listed below are examples of items that do not qualify for

sales and use tax exemption for timber items.

• Work clothes

• Computer and software used for accounting and general business purposes

• Materials used to construct roads or buildings used for shelter, housing, storage or work space

(examples include general storage sheds, offices or bunkhouses)

• Home furnishings and furniture

• Guns, ammunitions, traps and similar items

• Real property services such as nonresidential repair and remodeling, security and waste removal

*

Motor vehicles, including trailers, are taxed under Ch. 152 of the Tax Code. Exemption must be claimed on the Application for Texas

Certificate of Title/Tax Statement, Form 130-U, when filed with the local County Tax Assessor-Collector at the time of registration and/or

titling. Additional information is available online at

Exempt If Used Exclusively to Produce Timber for Sale

Listed below are examples of items exempt from sales and use tax if used exclusively for

timber production and purchased by a person who holds a current ag/timber number.

Axes

Fertilizer fungicides

Recycler grinder

Boards or mats used for access to

Fertilizer spreader

Repair/replacement parts for qualified

commercial timber sites

Front end loader

equipment

Bobcats

Grapple

Ropes

Brush cutter

Hand saws

Seedlings of trees grown for

Bulldozer

Harnesses for tree climbing

commercial timber

Chain saws

Harvester

Skidders

Chippers

Herbicides

Slasher saw

Compressors

Hot saw

Sprinkler systems components

Crawler carrier

Hydro-ax

Stackers

Defoliants

Insecticides

Stump grinder

Delimber

Knucklebooms

Tractors

Desiccants

Loaders

Tree cutter

Ear protection devices

Lubricants

Tree measurement devices

Excavator

Mobile yarder

Tree spade

Eye protection goggles

Mulching machines

Welding machines

Feller buncher

Prehauler

Winch

Tax Help: tax.help@cpa.state.tx.us

Window on State Government:

Tax Assistance: 1-800-252-5555 or 512-463-4600

Sign up to receive email updates on the Comptroller topics of your choice at /subscribe.

1

1 2

2