Clear This Page

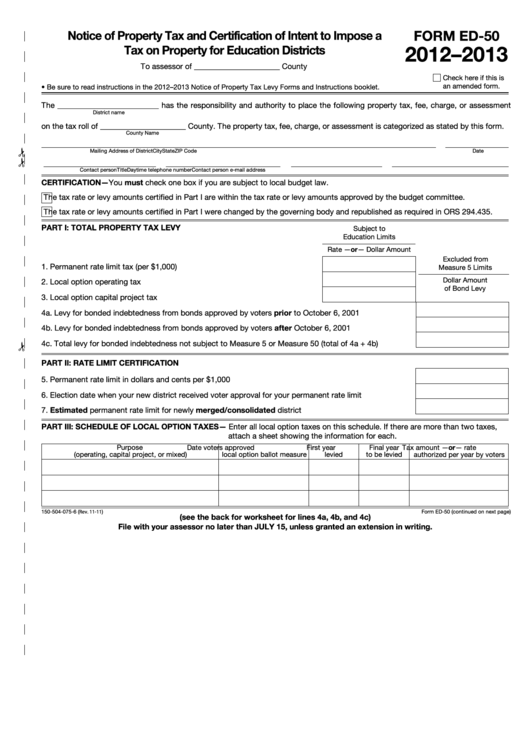

FORM ED-50

Notice of Property Tax and Certification of Intent to Impose a

2012–2013

Tax on Property for Education Districts

To assessor of ______________________ County

Check here if this is

an amended form.

• Be sure to read instructions in the 2012–2013 Notice of Property Tax Levy Forms and Instructions booklet.

The __________________________ has the responsibility and authority to place the following property tax, fee, charge, or assessment

District name

on the tax roll of ______________________ County. The property tax, fee, charge, or assessment is categorized as stated by this form.

County Name

Mailing Address of District

City

State

ZIP Code

Date

Contact person

Title

Daytime telephone number

Contact person e-mail address

CERTIFICATION—You must check one box if you are subject to local budget law.

The tax rate or levy amounts certified in Part I are within the tax rate or levy amounts approved by the budget committee.

The tax rate or levy amounts certified in Part I were changed by the governing body and republished as required in ORS 294.435.

PART I: TOTAL PROPERTY TAX LEVY

Subject to

Education Limits

Rate —or— Dollar Amount

Excluded from

1. Permanent rate limit tax (per $1,000) .............................................................1

Measure 5 Limits

Dollar Amount

2. Local option operating tax .............................................................................2

of Bond Levy

3. Local option capital project tax ......................................................................3

4a. Levy for bonded indebtedness from bonds approved by voters prior to October 6, 2001 ....................4a

4b. Levy for bonded indebtedness from bonds approved by voters after October 6, 2001 ....................... 4b

4c. Total levy for bonded indebtedness not subject to Measure 5 or Measure 50 (total of 4a + 4b) ............4c

PART II: RATE LIMIT CERTIFICATION

5. Permanent rate limit in dollars and cents per $1,000 ................................................................................5

6. Election date when your new district received voter approval for your permanent rate limit ...................6

7. Estimated permanent rate limit for newly merged/consolidated district ...............................................7

PART III: SCHEDULE OF LOCAL OPTION TAXES— Enter all local option taxes on this schedule. If there are more than two taxes,

attach a sheet showing the information for each.

Purpose

Date voters approved

First year

Final year

Tax amount —or— rate

(operating, capital project, or mixed)

local option ballot measure

levied

to be levied

authorized per year by voters

Form ED-50 (continued on next page)

150-504-075-6 (Rev. 11-11)

(see the back for worksheet for lines 4a, 4b, and 4c)

File with your assessor no later than JULY 15, unless granted an extension in writing.

1

1 2

2