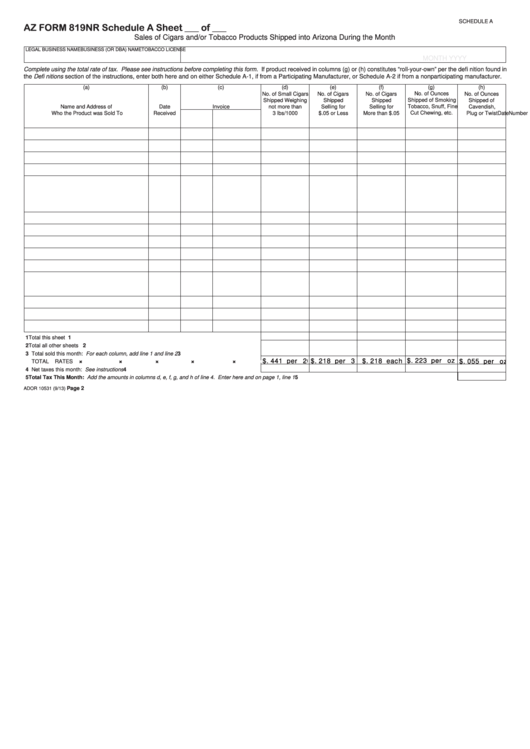

SCHEDULE A

AZ FORM 819NR

Schedule A

Sheet ___ of ___

Sales of Cigars and/or Tobacco Products Shipped into Arizona During the Month

LEGAL BUSINESS NAME

BUSINESS (OR DBA) NAME

TOBACCO LICENSE NO.

FOR THE MONTH OF

MONTH YYYY

Complete using the total rate of tax. Please see instructions before completing this form. If product received in columns (g) or (h) constitutes “roll-your-own” per the defi nition found in

the Defi nitions section of the instructions, enter both here and on either Schedule A-1, if from a Participating Manufacturer, or Schedule A-2 if from a nonparticipating manufacturer.

(g)

(a)

(b)

(c)

(d)

(e)

(f)

(h)

No. of Ounces

No. of Small Cigars

No. of Cigars

No. of Cigars

No. of Ounces

Shipped of Smoking

Shipped Weighing

Shipped

Shipped

Shipped of

Name and Address of

Date

Invoice

not more than

Selling for

Selling for

Tobacco, Snuff, Fine

Cavendish,

Cut Chewing, etc.

Who the Product was Sold To

Received

Date

Number

3 lbs/1000

$.05 or Less

More than $.05

Plug or Twist

1 Total this sheet .......................................................................................................................... 1

2 Total all other sheets ................................................................................................................ 2

3 Total sold this month: For each column, add line 1 and line 2 .................................................. 3

$.218 each $.223 per oz. $.055 per oz.

$.441 per 20$.218 per 3

$.263 p er 20

$.130 p er 3

$.133 p er oz.

$.033 p er oz.

×

×

×

$.130 each

×

×

TOTAL RATES ...........................................................................................................................

4 Net taxes this month: See instructions ..................................................................................... 4

5 Total Tax This Month: Add the amounts in columns d, e, f, g, and h of line 4. Enter here and on page 1, line 1 ..................................................................................................... 5

Page 2

ADOR 10531 (9/13)

1

1 2

2 3

3