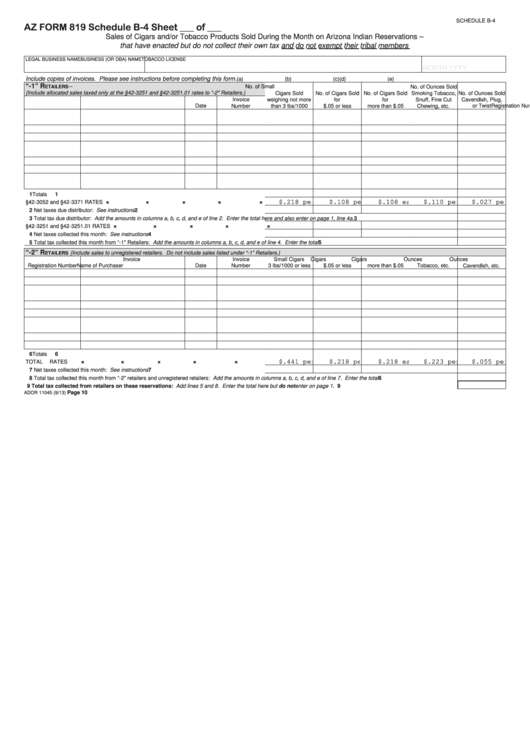

SCHEDULE B-4

AZ FORM 819

Schedule B-4

Sheet ___ of ___

Sales of Cigars and/or Tobacco Products Sold During the Month on Arizona Indian Reservations –

that have enacted but do not collect their own tax and do not exempt their tribal members

LEGAL BUSINESS NAME

BUSINESS (OR DBA) NAME

TOBACCO LICENSE NO.

RESERVATION NAME

FOR THE MONTH OF

MONTH YYYY

Include copies of invoices. Please see instructions before completing this form.

(a)

(b)

(c)

(d)

(e)

“-1” R

--

No. of Small

No. of Ounces Sold

ETAILERS

(Include allocated sales taxed only at the §42-3251 and §42-3251.01 rates to “-2” Retailers.)

Cigars Sold

No. of Cigars Sold

No. of Cigars Sold

Smoking Tobacco,

No. of Ounces Sold

Invoice

Invoice

weighing not more

for

for

Snuff, Fine Cut

Cavendish, Plug,

Registration Number

Name of Purchaser

Date

Number

than 3 lbs/1000

$.05 or less

more than $.05

Chewing, etc.

or Twist

1 Totals ........................................................................................................................................

1

$.218 p er 20

$.108 p er 3

$.110 p er oz.

$.027 p er oz.

×

$.218 per 20 $.108 per 3 $.108 each $.110 per oz. $ .027 per oz.

×

×

$.108 each

×

×

§42-3052 and §42-3371 RATES ..............................................................................................

2 Net taxes due distributor: See instructions ..............................................................................

2

3 Total tax due distributor: Add the amounts in columns a, b, c, d, and e of line 2. Enter the total here and also enter on page 1, line 4a. ..............................................................

3

$.223 p er 20

$.110 p er 3

$.113 p er oz.

$.028 p er oz.

×

×

×

$.110 each

×

×

§42-3251 and §42-3251.01 RATES ............................................................................................

4 Net taxes collected this month: See instructions .....................................................................

4

5 Total tax collected this month from “-1” Retailers: Add the amounts in columns a, b, c, d, and e of line 4. Enter the total ......................................................................................

5

“-2” R

ETAILERS

(Include sales to unregistered retailers. Do not include sales listed under “-1” Retailers.)

Invoice

Invoice

Small Cigars

Cigars

Cigars

Ounces

Ounces

Registration Number

Name of Purchaser

Date

Number

3 lbs/1000 or less

$.05 or less

more than $.05

Tobacco, etc.

Cavendish, etc.

6 Totals ........................................................................................................................................

6

$.441 p er 20

$.218 p er 3

$.223 p er oz.

$.055 p er oz.

×

$.441 per 20 $.218 per 3 $.218 each $.223 per oz. $ .055 per oz.

×

×

$.218 each

×

×

TOTAL RATES .........................................................................................................................

7 Net taxes collected this month: See instructions .....................................................................

7

8 Total tax collected this month from “-2” retailers and unregistered retailers: Add the amounts in columns a, b, c, d, and e of line 7. Enter the total .............................................

8

9 Total tax collected from retailers on these reservations: Add lines 5 and 8. Enter the total here but do not enter on page 1. ........................................................................

9

Page 10

ADOR 11045 (9/13)

1

1 2

2