Form R-20213 - Authorization Agreement For Electronic Funds Transfer (Eft) Of Tax Payment Page 2

ADVERTISEMENT

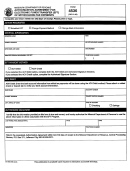

Authorization Agreement for

Electronic Funds Transfer (EFT) of Tax Payment

Tax type

New Application

Change Document (effective date) ______________________

Enter both the tax type name and the corresponding

This section must be completed regardless of the payment method selected.

National Automated Clearinghouse Association (NACHA)

I

Taxpayer name

Revenue Account Number

code, as follows, in the appropriate place at left.

Sales Tax

Federal Identification Number

(if applicable)

Tax type - Enter the tax type name and the corresponding

General Sales (R-0129)

04101

5-digit NACHA Code from the list at right.

Hotel/Motel Jefferson/Orleans (R-1029 DS)

04121

NOEH Hotel Room Occupancy Tax (R-1325)

04131

Automobile Rental Excise Tax (R-1329)

04111

A separate authorization is required for each tax type.

Statewide Hotel/Motel

04141

Severance Tax

Requested effective tax period

Oil Severance

08100

Anticipated date of first transmission

Gas Severance

08200

Contact person

Telephone

Contact person

Telephone

Mineral Severance

08600

(

)

(

)

Timber Severance

08700

Mailing address for EFT purposes (street address, box number)

Other taxes

Withholding

01100

Mailing address (city, state, ZIP)

Corporation Income/Franchise

02200

Natural Gas Franchise Tax

08220

Oilfield Restoration (oil)

08111

ll

ACH Debit

Oilfield Restoration (gas)

08211

I hereby authorize the Louisiana Department of Revenue to present debit entries into the bank account and the depository named

Excise Taxes

below. The individual debit transactions will be presented only after having been expressly authorized and initiated by the taxpayer.

These debits will pertain only to Electronic Funds Transfer payments that the taxpayer has initiated for payment of Louisiana taxes.

Alcohol

06401

Beer Returns

06301

Signature

Title

Date

Gasoline Dealer

05101

Gasoline Jobber

05111

Bank name

Branch

Gasoline User

05121

Hazardous Waste

09001

Bank contact person

Telephone

Inspection and Supervision

15001

(

)

Special Fuels Decals

05221

Bank account number

Type of account

Special Fuels Supplier

05201

Checking

Savings

Special Fuels User

05211

Transit and routing

Name on bank account

–

Tobacco Permits

07321

number

Tobacco Returns

07301

Please attach a copy of voided check or deposit slip.

Transportation and Communication

15011

lll

ACH Credit with Addenda

(225)219-7318

For assistance, call:

Before choosing the ACH Credit with Addenda option, check with your financial institution to be sure it can accommodate your needs.

Corporation Income & Franchise Taxes

Mail application to: Louisiana Department of Revenue

Excise Taxes

For office use only.

EFT Processing

Sales Tax

Effective tax period

Initials

P.O. Box 4018

Severance Tax

Baton Rouge, LA 70821-4018

Withholding Tax

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2