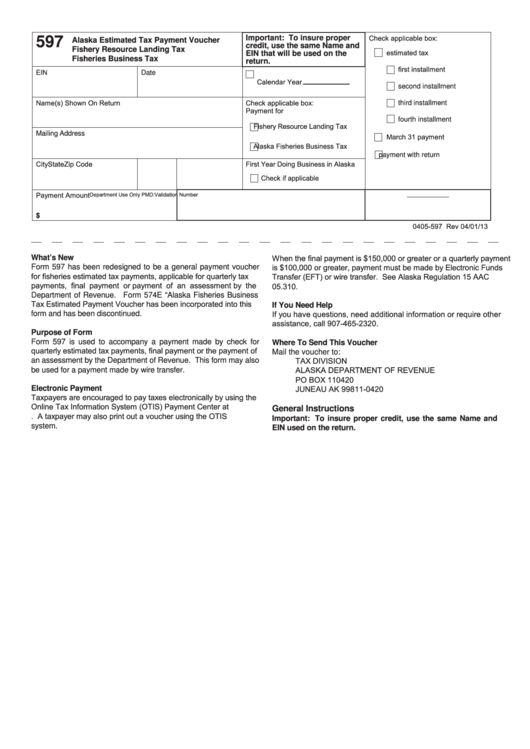

Form 0405-597 - Alaska Estimated Tax Payment Voucher Fishery Resource Landing Tax Fisheries Business Tax

ADVERTISEMENT

Check applicable box:

Important: To insure proper

597

Alaska Estimated Tax Payment Voucher

credit, use the same Name and

Fishery Resource Landing Tax

estimated tax

EIN that will be used on the

Fisheries Business Tax

return.

first installment

EIN

Date

Calendar Year

second installment

Check applicable box:

Name(s) Shown On Return

third installment

Payment for

fourth installment

Fishery Resource Landing Tax

Mailing Address

March 31 payment

Alaska Fisheries Business Tax

payment with return

City

State

Zip Code

First Year Doing Business in Alaska

Check if applicable

Payment Amount

Department Use Only PMD:

Validation Number

$

0405-597 Rev 04/01/13

When the final payment is $150,000 or greater or a quarterly payment

What’s New

is $100,000 or greater, payment must be made by Electronic Funds

Form 597 has been redesigned to be a general payment voucher

for fisheries estimated tax payments, applicable for quarterly tax

Transfer (EFT) or wire transfer. See Alaska Regulation 15 AAC

payments, final payment or payment of an assessment by the

05.310.

Department of Revenue.

Form 574E “Alaska Fisheries Business

Tax Estimated Payment Voucher has been incorporated into this

If You Need Help

If you have questions, need additional information or require other

form and has been discontinued.

assistance, call 907-465-2320.

Purpose of Form

Form 597 is used to accompany a payment made by check for

Where To Send This Voucher

quarterly estimated tax payments, final payment or the payment of

Mail the voucher to:

TAX DIVISION

an assessment by the Department of Revenue. This form may also

ALASKA DEPARTMENT OF REVENUE

be used for a payment made by wire transfer.

PO BOX 110420

JUNEAU AK 99811-0420

Electronic Payment

Taxpayers are encouraged to pay taxes electronically by using the

Online Tax Information System (OTIS) Payment Center at

General Instructions

alaska.gov. A taxpayer may also print out a voucher using the OTIS

Important: To insure proper credit, use the same Name and

system.

EIN used on the return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1