Instructions For Alaska Application To Purchase Cigarette Tax Stamps On A Deferred Payment Basis

ADVERTISEMENT

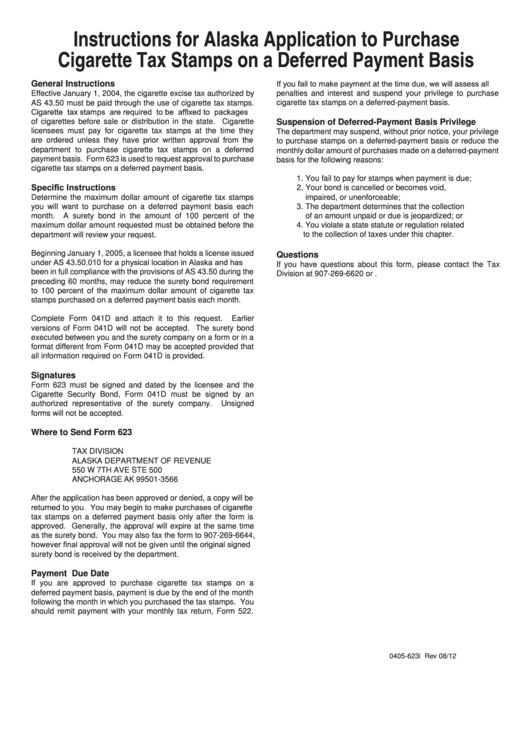

Instructions for Alaska Application to Purchase

Cigarette Tax Stamps on a Deferred Payment Basis

If you fail to make payment at the time due, we will assess all

General Instructions

penalties and interest and suspend your privilege to purchase

Effective January 1, 2004, the cigarette excise tax authorized by

AS 43.50 must be paid through the use of cigarette tax stamps.

cigarette tax stamps on a deferred-payment basis.

Cigarette tax stamps are required to be affixed to packages

of cigarettes before sale or distribution in the state. Cigarette

Suspension of Deferred-Payment Basis Privilege

licensees must pay for cigarette tax stamps at the time they

The department may suspend, without prior notice, your privilege

are ordered unless they have prior written approval from the

to purchase stamps on a deferred-payment basis or reduce the

department to purchase cigarette tax stamps on a deferred

monthly dollar amount of purchases made on a deferred-payment

payment basis. Form 623 is used to request approval to purchase

basis for the following reasons:

cigarette tax stamps on a deferred payment basis.

1. You fail to pay for stamps when payment is due;

Specific Instructions

2. Your bond is cancelled or becomes void,

Determine the maximum dollar amount of cigarette tax stamps

impaired, or unenforceable;

you will want to purchase on a deferred payment basis each

3. The department determines that the collection

of an amount unpaid or due is jeopardized; or

month. A surety bond in the amount of 100 percent of the

maximum dollar amount requested must be obtained before the

4. You violate a state statute or regulation related

department will review your request.

to the collection of taxes under this chapter.

Beginning January 1, 2005, a licensee that holds a license issued

Questions

under AS 43.50.010 for a physical location in Alaska and has

If you have questions about this form, please contact the Tax

been in full compliance with the provisions of AS 43.50 during the

Division at 907-269-6620 or dor.tax.cigarette@alaska.gov.

preceding 60 months, may reduce the surety bond requirement

to 100 percent of the maximum dollar amount of cigarette tax

stamps purchased on a deferred payment basis each month.

Complete Form 041D and attach it to this request.

Earlier

versions of Form 041D will not be accepted. The surety bond

executed between you and the surety company on a form or in a

format different from Form 041D may be accepted provided that

all information required on Form 041D is provided.

Signatures

Form 623 must be signed and dated by the licensee and the

Cigarette Security Bond, Form 041D must be signed by an

authorized representative of the surety company.

Unsigned

forms will not be accepted.

Where to Send Form 623

TAX DIVISION

ALASKA DEPARTMENT OF REVENUE

550 W 7TH AVE STE 500

ANCHORAGE AK 99501-3566

After the application has been approved or denied, a copy will be

returned to you. You may begin to make purchases of cigarette

tax stamps on a deferred payment basis only after the form is

approved. Generally, the approval will expire at the same time

as the surety bond. You may also fax the form to 907-269-6644,

however final approval will not be given until the original signed

surety bond is received by the department.

Payment Due Date

If you are approved to purchase cigarette tax stamps on a

deferred payment basis, payment is due by the end of the month

following the month in which you purchased the tax stamps. You

should remit payment with your monthly tax return, Form 522.

0405-623i Rev 08/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1