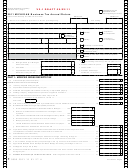

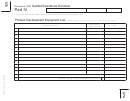

Schedule SPD Credit and Recapture Summary

Part I

EIN/SSN

Taxpayer name

Enter license numbers of each facility/vessel that generated a credit (from Part IV)

Total All

or that is subject to recapture (from Part III) in this tax period

Licenses

1. Fish. Bus. Lic. #

2. Fish. Bus. Lic. #

3. Fish. Bus. Lic. #

4. Fish. Bus. Lic. #

Credit carryforward (line 9 from prior year)

1

Enter the amount of credit carryforward that is subject to recapture in Part III. If none,

Carryforward subject to recapture

2

enter zero

Net carryforward (subtract line 2 from

3

line 1)

Amount from Part II, line 4 for each license listed above

1

2

3

4

Credit generated this year

4

Enter total of all licensed facilities in Total All Licenses column

Total credits available (line 3 plus line 4)

5

Enter tax for each license

1

2

3

4

6

Tax on salmon for each licensed facility

50% of line 6 for each license, enter total in Total All Licenses column

1

2

3

4

Tax limitation, 50% of line 6

7

Allocate your credit to individual licensed facilities

Credit (enter the lesser of line 5 or line 7)

1

2

3

4

8

Enter credit from line 8 on the Fisheries Business Tax return for the appropriate

license.

Attach this form to each tax return to which credit or recapture was allocated

Unused credit carryforward, subtract line

9

8 from line 5 (but not less than zero)

Add from Part III, line 5 for each separate license

Total tentative recapture tax

1

2

3

4

10

(from part III, line 5)

11 Adjustments

Enter the amount from line 2 above

Allocate to individual licenses

1

2

3

4

12 Recapture tax allocation, line 10 less line 11

0.00

Enter recapture tax from line 12 on the Fisheries Business Tax Return for the appropriate license. Attach this form to each return to which recapture tax is allo-

cated. All recapture tax must be allocated.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46