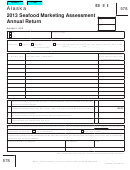

ALASKA FISHERIES PROCESSING LOCATION CODE

MAPS & DIRECTORY

INSTRUCTIONS

1. PURPOSE

Fisheries Business Tax and Fishery Resource Landing Tax are shared with all organized

boroughs and incorporated cities within the State of Alaska. This directory provides the

taxpayer with a complete list of all incorporated cities with an assigned code for each to

simplify the reporting process. Also, maps are provided to help identify the correct

location code to use when processing or landing took place outside of an incorporated

city within the state.

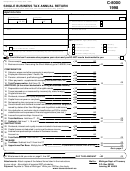

2. DETERMINING A LOCATION CODE

To determine the correct location code to report, use the guidelines as follows:

If fisheries resources were:

• Processed or landed within the city limits of an incorporated city in Alaska, use the

location code of that incorporated city (See list on page 2).

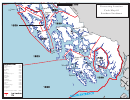

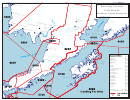

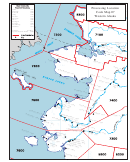

• Processed or landed outside the city limits of an incorporated city but within Alaskan

waters, go to the area maps on pages 3 – 9 and use the location code (listed in bold

numbers) for the area where the processing or landing took place.

• Exported unprocessed outside of Alaska,

use location code 8888

.

• Pollock harvested in the Alaska Pollock fishery and not landed in Alaska (subject to

use location code 9000

tax in accordance with the American Fisheries Act),

.

Enter one location code in the assigned block for each line entry on the Fisheries

Business Tax or Fishery Resource Landing Tax return. Report each unique combination

of species and location separately.

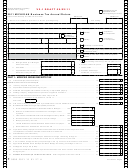

3. IF YOU NEED HELP

If you have questions regarding processing locations, contact the Share Tax Coordinator

at 907.465.3776 or by email at: Dor.tax.Excise@alaska.gov .

All information provided in this directory is available on our internet home page.

Our URL is:

Alaska.gov

www.

1

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46