Form Business Taxes Registration Certificate Partnership Or Corporation Instructions

ADVERTISEMENT

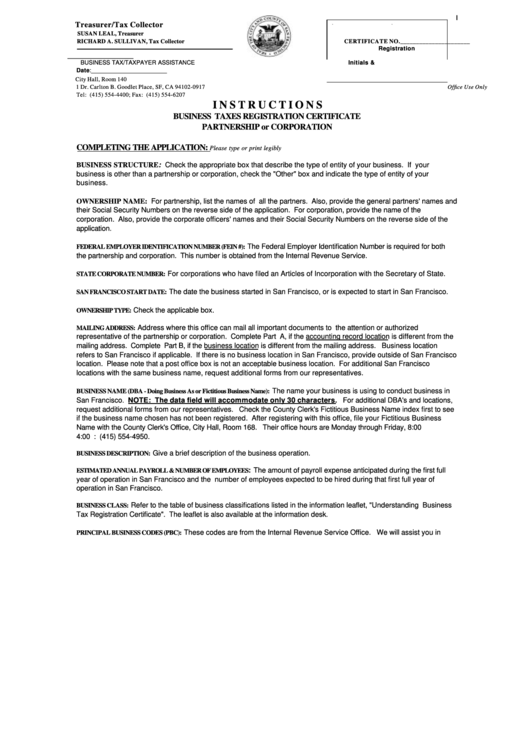

Treasurer/Tax Collector

SUSAN LEAL, Treasurer

RICHARD A. SULLIVAN, Tax Collector

CERTIFICATE NO.______________________

Registration

____________________

BUSINESS TAX/TAXPAYER ASSISTANCE

Initials &

Date:_______________________

City Hall, Room 140

1 Dr. Carlton B. Goodlet Place, SF, CA 94102-0917

Office Use Only

Tel: (415) 554-4400; Fax: (415) 554-6207

I N S T R U C T I O N S

BUSINESS TAXES REGISTRATION CERTIFICATE

PARTNERSHIP or CORPORATION

COMPLETING THE APPLICATION:

Please type or print legibly

BUSINESS STRUCTURE: Check the appropriate box that describe the type of entity of your business. If your

business is other than a partnership or corporation, check the "Other" box and indicate the type of entity of your

business.

OWNERSHIP NAME: For partnership, list the names of all the partners. Also, provide the general partners' names and

their Social Security Numbers on the reverse side of the application. For corporation, provide the name of the

corporation. Also, provide the corporate officers' names and their Social Security Numbers on the reverse side of the

application.

The Federal Employer Identification Number is required for both

FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN #):

the partnership and corporation. This number is obtained from the Internal Revenue Service.

For corporations who have filed an Articles of Incorporation with the Secretary of State.

STATE CORPORATE NUMBER:

The date the business started in San Francisco, or is expected to start in San Francisco.

SAN FRANCISCO START DATE:

Check the applicable box.

OWNERSHIP TYPE:

Address where this office can mail all important documents to the attention or authorized

MAILING ADDRESS:

representative of the partnership or corporation. Complete Part A, if the accounting record location is different from the

mailing address. Complete Part B, if the business location is different from the mailing address. Business location

refers to San Francisco if applicable. If there is no business location in San Francisco, provide outside of San Francisco

location. Please note that a post office box is not an acceptable business location. For additional San Francisco

locations with the same business name, request additional forms from our representatives.

The name your business is using to conduct business in

BUSINESS NAME (DBA - Doing Business As or Fictitious Business Name):

San Francisco. NOTE: The data field will accommodate only 30 characters. For additional DBA's and locations,

request additional forms from our representatives. Check the County Clerk's Fictitious Business Name index first to see

if the business name chosen has not been registered. After registering with this office, file your Fictitious Business

Name with the County Clerk's Office, City Hall, Room 168. Their office hours are Monday through Friday, 8:00 a.m. to

4:00 p.m. Telephone: (415) 554-4950.

Give a brief description of the business operation.

BUSINESS DESCRIPTION:

: The amount of payroll expense anticipated during the first full

ESTIMATED ANNUAL PAYROLL & NUMBER OF EMPLOYEES

year of operation in San Francisco and the number of employees expected to be hired during that first full year of

operation in San Francisco.

Refer to the table of business classifications listed in the information leaflet, "Understanding Business

BUSINESS CLASS:

Tax Registration Certificate". The leaflet is also available at the information desk.

These codes are from the Internal Revenue Service Office. We will assist you in

PRINCIPAL BUSINESS CODES (PBC):

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2