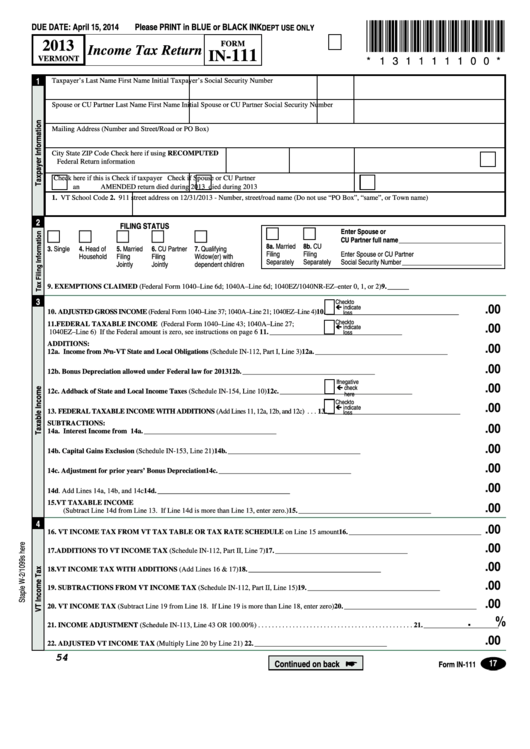

DUE DATE: April 15, 2014

Please PRINT in BLUE or BLACK INK

*131111100*

DEPT USE ONLY

2013

FORM

Income Tax Return

111

IN-

* 1 3 1 1 1 1 1 0 0 *

VERMONT

1

Taxpayer’s Last Name

First Name

Initial

Taxpayer’s Social Security Number

Spouse or CU Partner Last Name

First Name

Initial

Spouse or CU Partner Social Security Number

Mailing Address (Number and Street/Road or PO Box)

City

State

ZIP Code

Check here if using RECOMPUTED

Federal Return information

Check here if this is

Check if taxpayer

Check if Spouse or CU Partner

an AMENDED return

died during 2013

died during 2013

1. VT School Code

2. 911 street address on 12/31/2013 - Number, street/road name (Do not use “PO Box”, “same”, or Town name)

2

FILING STATUS

Enter Spouse or

c

c

c

c

c

c

c

CU Partner full name ________________________________

8a. Married

8b. CU

3. Single

4. Head of

5. Married

6. CU Partner

7. Qualifying

Filing

Filing

Enter Spouse or CU Partner

Household

Filing

Filing

Widow(er) with

Separately

Separately

Social Security Number _______________________________

Jointly

Jointly

dependent children

9.

EXEMPTIONS CLAIMED (Federal Form 1040–Line 6d; 1040A–Line 6d; 1040EZ/1040NR-EZ–enter 0, 1, or 2) . . . . . . . . . . . . . . . . . . . . . . . . . 9. ______

3

Check to

ç indicate

.0 0

loss

10. ADJUSTED GROSS INCOME (Federal Form 1040–Line 37; 1040A–Line 21; 1040EZ–Line 4)

10. _____________________________________

Check to

11. FEDERAL TAXABLE INCOME (Federal Form 1040–Line 43; 1040A–Line 27;

ç indicate

.0 0

loss

1040EZ–Line 6) If the Federal amount is zero, see instructions on page 6 . . . . . . . . . . . . . .

11. _____________________________________

ADDITIONS:

.0 0

12a. Income from Non-VT State and Local Obligations (Schedule IN-112, Part I, Line 3) . . . . . . . . . . . . . . . . 12a. _____________________________________

.0 0

12b. Bonus Depreciation allowed under Federal law for 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12b. _____________________________________

If negative

ç check

.0 0

12c. Addback of State and Local Income Taxes (Schedule IN-154, Line 10) . . . . . . . . . . . . . .

12c. _____________________________________

here

Check to

ç indicate

.0 0

loss

13. FEDERAL TAXABLE INCOME WITH ADDITIONS (Add Lines 11, 12a, 12b, and 12c) . . .

13. _____________________________________

SUBTRACTIONS:

.0 0

14a. Interest Income from U.S. Obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14a. _____________________________________

.0 0

14b. Capital Gains Exclusion (Schedule IN-153, Line 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14b. _____________________________________

.0 0

14c. Adjustment for prior years’ Bonus Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14c. _____________________________________

.0 0

14d . Add Lines 14a, 14b, and 14c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14d. _____________________________________

15. VT TAXABLE INCOME

.0 0

(Subtract Line 14d from Line 13 . If Line 14d is more than Line 13, enter zero .) . . . . . . . . . . . . . . . . . . . . . 15. _____________________________________

4

.0 0

16. VT INCOME TAX FROM VT TAX TABLE OR TAX RATE SCHEDULE on Line 15 amount . . . . . 16. _____________________________________

.0 0

17. ADDITIONS TO VT INCOME TAX (Schedule IN-112, Part II, Line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . 17. _____________________________________

.0 0

18. VT INCOME TAX WITH ADDITIONS (Add Lines 16 & 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18. _____________________________________

.0 0

19. SUBTRACTIONS FROM VT INCOME TAX (Schedule IN-112, Part II, Line 15) . . . . . . . . . . . . . . . . . 19. _____________________________________

.0 0

20. VT INCOME TAX (Subtract Line 19 from Line 18 . If Line 19 is more than Line 18, enter zero) . . . . . . . 20. _____________________________________

%

.

21. INCOME ADJUSTMENT (Schedule IN-113, Line 43 OR 100 .00%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21. _____________________

.0 0

22. ADJUSTED VT INCOME TAX (Multiply Line 20 by Line 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22. _____________________________________

54

17

Continued on back

*

Form IN-111

1

1 2

2 3

3 4

4