Form Dor-558 - Military Information

ADVERTISEMENT

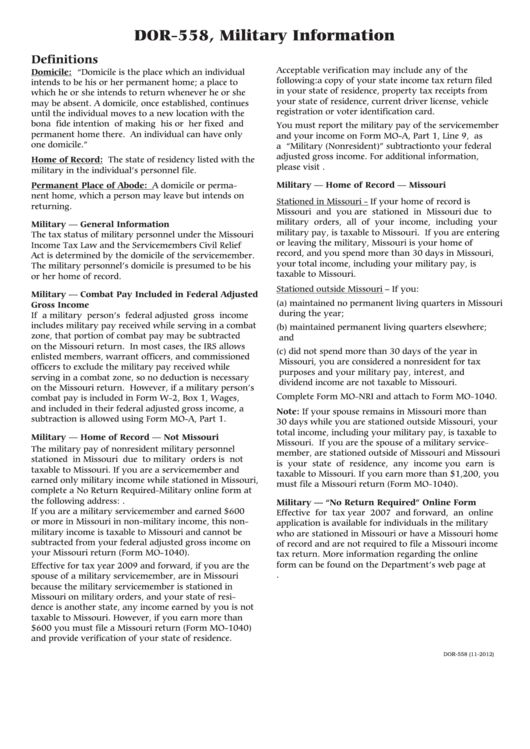

DOR-558, Military Information

Definitions

Acceptable verification may include any of the

Domicile: “Domicile is the place which an individual

following: a copy of your state income tax return filed

intends to be his or her permanent home; a place to

in your state of residence, property tax receipts from

which he or she intends to return whenever he or she

your state of residence, current driver license, vehicle

may be absent. A domicile, once established, continues

registration or voter identification card.

until the individual moves to a new location with the

bona fide intention of making his or her fixed and

You must report the military pay of the servicemember

permanent home there. An individual can have only

and your income on Form MO-A, Part 1, Line 9, as

one domicile.”

a “Military (Nonresident)” subtraction to your federal

adjusted gross income. For additional information,

Home of Record: The state of residency listed with the

please visit

military in the individual’s personnel file.

Permanent Place of Abode: A domicile or perma-

Military — Home of Record — Missouri

nent home, which a person may leave but intends on

Stationed in Missouri - If your home of record is

returning.

Missouri and you are stationed in Missouri due to

military orders, all of your income, including your

Military — General Information

military pay, is taxable to Missouri. If you are entering

The tax status of military personnel under the Missouri

or leaving the military, Missouri is your home of

Income Tax Law and the Servicemembers Civil Relief

record, and you spend more than 30 days in Missouri,

Act is determined by the domicile of the servicemember.

your total income, including your military pay, is

The military personnel’s domicile is presumed to be his

taxable to Missouri.

or her home of record.

Stationed outside Missouri – If you:

Military — Combat Pay Included in Federal Adjusted

(a) maintained no permanent living quarters in Missouri

Gross Income

during the year;

If a military person’s federal adjusted gross income

includes military pay received while serving in a combat

(b) maintained permanent living quarters elsewhere;

zone, that portion of combat pay may be subtracted

and

on the Missouri return. In most cases, the IRS allows

(c) did not spend more than 30 days of the year in

enlisted members, warrant officers, and commissioned

Missouri, you are considered a nonresident for tax

officers to exclude the military pay received while

purposes and your military pay, interest, and

serving in a combat zone, so no deduction is necessary

dividend income are not taxable to Missouri.

on the Missouri return. However, if a military person’s

Complete Form MO-NRI and attach to Form MO-1040.

combat pay is included in Form W-2, Box 1, Wages,

and included in their federal adjusted gross income, a

Note: If your spouse remains in Missouri more than

subtraction is allowed using Form MO-A, Part 1.

30 days while you are stationed outside Missouri, your

total income, including your military pay, is taxable to

Military — Home of Record — Not Missouri

Missouri. If you are the spouse of a military service-

The military pay of nonresident military personnel

member, are stationed outside of Missouri and Missouri

stationed in Missouri due to military orders is not

is your state of residence, any income you earn is

taxable to Missouri. If you are a servicemember and

taxable to Missouri. If you earn more than $1,200, you

earned only military income while stationed in Missouri,

must file a Missouri return (Form MO-1040).

complete a No Return Required-Military online form at

the following address: https://sa.dor.mo.gov/nri/.

Military — “No Return Required” Online Form

If you are a military servicemember and earned $600

Effective for tax year 2007 and forward, an online

or more in Missouri in non-military income, this non-

application is available for individuals in the military

military income is taxable to Missouri and cannot be

who are stationed in Missouri or have a Missouri home

subtracted from your federal adjusted gross income on

of record and are not required to file a Missouri income

your Missouri return (Form MO-1040).

tax return. More information regarding the online

form can be found on the Department’s web page at

Effective for tax year 2009 and forward, if you are the

spouse of a military servicemember, are in Missouri

because the military servicemember is stationed in

Missouri on military orders, and your state of resi-

dence is another state, any income earned by you is not

taxable to Missouri. However, if you earn more than

$600 you must file a Missouri return (Form MO-1040)

and provide verification of your state of residence.

DOR-558 (11-2012)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1