Delivery Seller

General Information

A person who makes delivery sales.

What is the PACT Act?

On June 29, 2010, the Prevent All Cigarette Trafficking Act (PACT Act) went into

Delivery Sale

effect. This federal law amends the Jenkins Act, 15 U.S.C. Chapter 10A, which

Any sale of cigarettes or smokeless tobacco to a consumer if-

governs the collection of taxes on, and trafficking in, cigarettes and smokeless

• the consumer orders by telephone or other method of voice transmission, the

tobacco. The PACT Act revised definitions in the Jenkins Act, provided new

mail, or the Internet or other online service, or the seller is otherwise not in the

physical presence of the buyer when the request for purchase or order is made; or

requirements for registration, reporting, record keeping, and increased penalties

for criminal violations. The PACT Act also generally prohibits mailing cigarettes

• the cigarettes or smokeless tobacco products are delivered to the buyer by

and smokeless tobacco through the U.S. Postal Service.

common carrier, private delivery service, or other method of remote delivery; or

• the seller is not in the physical presence of the buyer when the buyer obtains

What tobacco products are covered under the PACT Act?

possession of the cigarettes or smokeless tobacco.

Cigarettes and smokeless tobacco are covered.

Interstate Commerce

According to 18 U.S.C. 2341 and 25 U.S.C. 5702, cigarettes include:

The term “interstate commerce” includes commerce between any place in a State

• Any roll of tobacco wrapped in paper or in any substance not containing

and any place outside of that State, commerce between a State and Indian Country

tobacco.

in the State, or commerce between points in the same State but through any place

• Any roll of tobacco wrapped in any substance containing tobacco which,

outside the State or through any Indian Country. The term “State” includes the

because of its appearance, the type of tobacco used in the filler, or its

District of Columbia, the Commonwealth of Puerto Rico, and the possessions of the

packaging and labeling is likely to be offered to, or purchased by, consumers

United States.

as a cigarette as described in the bullet above.

• Roll-your-own tobacco.

Person

The term “person” means an individual, corporation, company, association, firm,

Smokeless tobacco includes:

partnership, society, State government, local government, Indian tribal government,

• Tobacco products that are non-combustible (primarily various forms of

governmental organization of such a government, or joint stock company.

chewing tobacco, snuff, snus, etc.)

Who must file this report?

Instructions

You must file this report if you advertise, offer for sale, sell, transfer, or ship (for

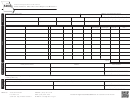

Business

profit) cigarettes in interstate commerce. These cigarettes must be shipped into

Provide your business name, location and mailing address, reporting period, FEIN,

e-mail address, and your State Identification Number for the state you are shipping

another state, locality, or Indian nation that taxes the sale or use of cigarettes.

into. If you do not hold a license, permit, registration, or other identification number in

When do I file?

the state you are shipping into, write “None” in that field.

The report is due no later than the 10th day of each calendar month for the previous

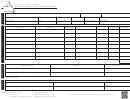

Sales

calendar month’s shipments.

Provide your customer’s name, address, sales price, brand family, invoice date,

invoice number and total sticks of cigarettes sold. Do not report cigarettes in cases,

Definitions

cartons, or packs.

Common Carrier

Any person (other than a local messenger service or the U.S. Postal Service) that

Delivery Service

Please see definition of delivery seller and delivery sales above. Provide your

holds itself out to the general public as a provider for hire of the transportation by

water, land, or air of merchandise (regardless of whether the person actually operates

delivery service name, address, and phone number.

the vessel, vehicle, or aircraft by which the transportation is provided) between a port

Signature

or place and a port or place in the United States.

Sign and date the form and provide the name, title, and phone number of the

Consumer

responsible party.

A consumer is any person who purchases cigarettes or smokeless tobacco. This does

not include any person lawfully operating as a manufacturer, distributor, wholesaler,

or retailer of cigarettes or smokeless tobacco.

Form 5467 (Revised 06-2013)

1

1 2

2