1972-2013 Schedule Of Franchise Tax Rates, Litter Tax Rates, Interest And Penalty Page 2

ADVERTISEMENT

1972-2013 Schedule of Franchise Tax Rates, Litter Tax Rates, Interest and Penalty

Rev. 1/13

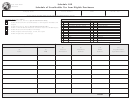

Litter Tax Rates

Franchise Tax Rate

Tier One

Tier Two

Net Income Basis

Net Income Basis

Net Income

First

Over

First

Over

Over

Taxable Year

$50,000

$50,000

$50,000

$50,000

$50,000

Ending

Addition

(First $25,000

(Over $25,000

(First $25,000

(Over $25,000

(Over $25,000

Franchise

On or Between

Minimum

Net Worth

Phase-out

Net Worth

Net Worth

Interest

to

Prior to

Prior to

Prior to

Prior to

Prior to

Tax Year

Dates Shown

Fee

Basis

Surtax

Basis

Basis

Rate

Tax Penalty

1989 Report)

1989 Report)

%****

1989 Report)

1989 Report)

1989 Report)

0.0022

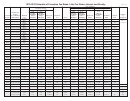

1983

1/1/82–12/31/82

$150

4.6%

8.7%

0.0055

N/A

5.75%

0.0011

0.00014

0.0022

0.00014

10%

25%

0.0022

1982

1/1/81–11/14/81

$50

4.0%

8.0%

0.005

N/A

15%

0.0011

0.00014

0.0022

0.00014

6%

25%

0.0022

11/15/81–12/18/81

$150

4.6%

8.7%

0.0055

N/A

0

0.0011

0.00014

0.0022

0.00014

6%

25%

12/19/81–12/31/81

$150

4.6%

8.7%

0.0055

N/A

0.0011

0.0022

0.00014

25%

20.75%

0.00014

0.0022

6%

N/A

1981

1/1/80–7/14/80

$50

4.0%

8.0%

0.005

N/A

N/A

N/A

N/A

N/A

N/A

6%

25%

0.0011

7/15/80–12/18/80

$50

4.0%

8.0%

0.005

N/A

N/A

0.0022

0.00014

0.0022

0.00014

6%

25%

0.0011

0.0022

12/19/80–12/31/80

$50

4.0%

8.0%

0.005

N/A

15%

0.00014

0.0022

0.00014

25%

6%

N/A

1980

1/1/79–12/31/79

$50

4.0%

8.0%

0.005

N/A

N/A

N/A

N/A

N/A

6%

25%

N/A

1972-1979

Prior to 1979

$50

4.0%

8.0%

0.005

N/A

N/A

N/A

N/A

N/A

N/A

6%

25%

N/A

* Effective for taxable years ending after 6/30/83, the surtax is only applicable if the net income basis exceeds the

*** Effective for taxable years ending after June 25, 2003, the minimum fee is $1,000 if (1) the sum of the taxpayer’s

net worth basis.

gross receipts from activities within and without Ohio during the taxable year equals or exceeds $5 million, or (2)

the total number of the taxpayer’s employees within and without Ohio during the taxable year equals or exceeds

** For each month or fraction of a month that the Ohio Corporation Franchise Tax Report (form FT 1120) was de-

300. For more information, see instructions on the department’s Web site at tax.ohio.gov.

linquent, the corporation is liable for the Failure to File (or timely fi le) penalty. This penalty is the greater of $50

per month up to $500 or 5% per month (50% maximum) of the net tax due shown on the delinquent report. All

**** Effective for taxable years ending in 2005, H.B. 66 enacted a commercial activities tax and began a phase-out

delinquent reports, including reports which (1) indicate an overpayment or no balance due or (2) an informational

of the corporation franchise tax beginning with tax year 2006. See R.C. 5751. Taxpayers described in R.C.

report (FT 1120S), are subject to the “Failure to File” penalty.

5751.01(E)(5), (6), (7), (8) or (10) are not subject to the franchise tax phase-out. See R.C. 5733.01(G)(2). Ad-

ditionally, fi nancial institutions remain subject to the franchise tax and must fi le Ohio form FT 1120FI.

In addition to the above penalty, there is also a penalty for failure to pay (or timely pay) the tax computed on

the delinquent report. For report years 2003 and forward, the penalty is not to exceed 15% of the delinquent

payment. For report years 1988-2002, the penalty equals twice the interest charged under Ohio Revised Code

section (R.C.) 5733.26(A).

For additional information on delinquencies, please contact the offi ce on the delinquency notice.

- 2 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2