Instructions for ordering cigarette tax stamps

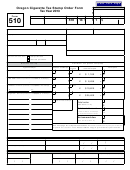

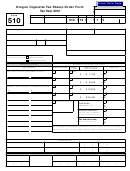

Note: You must use this form in this format for EACH new order.

Complete the Distributor Use area

.

Deferred customers may fax orders to:

You must fill in your license number, business iden-

tification number (BIN), name, shipping address,

Cigarette Tax, 503-947-2255.

city, state, ZIP code, and all courier information.

Confirm receipt at 503-947-2279.

If your order is missing information, it may be

Please title your fax cover sheet "Attention

returned to you for completion.

Stamp Orders."

1a–5a: Number of stamps. Enter number of each

The deadline to fax a deferred order is 11:00 am.

type of stamp ordered in appropriate boxes 1a

through 4a. Add amounts in boxes 1a through 4a

If you fax your order: When you send the payment

and put total in box 5a.

with the order form on a previously faxed order,

be sure to write on the order: “COPY ONLY—DO

1b–4b: Number of each. Enter the number of pads

NOT FILL. Order previously faxed.” This will

or rolls ordered in appropriate boxes 1b through 4b.

prevent duplicate orders being sent to you.

1–4: Total price. Calculate the total price for each

For customers who want to pick up stamps:

type of stamp ordered. Enter the amounts in boxes

Please remember that your order will be available

1 through 4.

for pick up after 1:30 p.m., Monday–Friday.

5: Total order. Add amounts in boxes 1 through 4.

Please do not use stamp order forms when only

Enter total in box 5.

making a payment towards cigarette tax amounts

6: Calculate discount amount. To calculate your

owing unless it was a previously faxed order as

discount:

indicated above.

Multiply the Total number of stamps (box 5a) by

Taxpayer assistance

the discount rate. The discount rate is $0.004 per

stamp. Do not multiply the discount rate by the

General tax information .....

tax value or purchase price of stamps.

Tax Services ......................................... 503-378-4988

Tax Services:

... 1-800-356-4222

Toll-free from Oregon prefix

Enter your discount amount in box 6.

Salem Special Programs Admin. Unit ... 503-945-8120

7: Net amount due. Total order amount (box 5), less

Salem tip line ...................................... 503-947-2106

discount amount (box 6) equals your net amount

Toll-free tip line ...............................1-866-840-2740

due. Enter the net amount due in box 7. This is the

Asistencia en español:

amount to pay with your order, or you may defer

Salem .................................................... 503-378-4988

payment if you have a deferred payment account.

Gratis de prefijo de Oregon ...........1-800-356-4222

Mail your order and payment

(payment must be by

TTY (hearing or speech impaired; machine only):

to:

cashier's check or money order)

Salem .................................................... 503-945-8617

Toll-free from Oregon prefix ..........1-800-886-7204

Cigarette Tax

Oregon Department of Revenue

Americans with Disabilities Act (ADA): Call one

PO Box 14630

of the help numbers for information in alternative

Salem OR 97309-5050

formats.

150-105-020 (Rev. 04-12)

1

1 2

2