Form Rpd-41375 - New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax - 2013 Page 3

ADVERTISEMENT

State of New Mexico - Taxation and Revenue Department

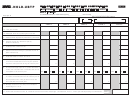

RPD-41375 2013

Int. 09/30/2013

2013 New Mexico Net Operating Loss Carryforward Schedule

for Fiduciary Income Tax - Instructions - Page 2 of 3

Worksheet 1, for Column 2 of the Carryforward Schedule

Computing the NM NOL incurred in prior years.

Line 1. Federal NOL as defined by Section 172(c) of the Internal Revenue Service for the tax year of the loss.

Line 2. Interest received on U.S. Government obligations less related expenses and reported on the New Mexico

tax return for the tax year of the loss. This amount is reported on FID-1, page 2, line 5, in the tax year of

the loss.

Line 3. Enter the sum of lines 1 and 2. This is the NM NOL loss incurred in the year of the loss to be reported in

column 2 of the Carryforward Schedule.

Worksheet 2, for Columns 3 and 4 of the Carryforward Schedule.

Computing the net income before NM NOL is applied

and the loss used in the current tax year.

From the 2013 FID-1:

1.

Enter the 2013 federal taxable income of the fiduciary, reported on FID-1, line 1.

2.

Enter the additions to federal income, reported on FID-1, page 1, line 2.

Enter the sum of lines 1 and 2. This is the net income before the NM NOL is applied. Enter in

3.

column 3, row 1.

4.

Enter the sum of prior year NM NOL carryforward available.

Enter the lesser of lines 3 and 4. This is the excludable New Mexico NOL carryforward amount.

5.

Also enter this amount on line 1, at the bottom of Column 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4