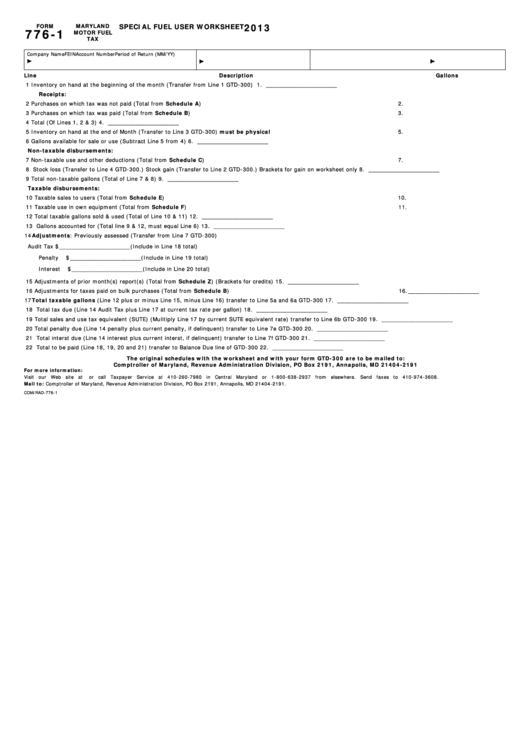

2013

FORM

MARYLAND

SPECIAL FUEL USER WORKSHEET

776-1

MOTOR FUEL

TAX

Company Name

FEIN

Account Number

Period of Return (MM/YY)

Line

Description

Gallons

1

Inventory on hand at the beginning of the month (Transfer from Line 1 GTD-300)

1. _____________________

Receipts:

2

Purchases on which tax was not paid (Total from Schedule A)

2. _____________________

3

Purchases on which tax was paid (Total from Schedule B)

3. _____________________

4

Total (Of Lines 1, 2 & 3)

4. _____________________

5

Inventory on hand at the end of Month (Transfer to Line 3 GTD-300) must be physical

5. _____________________

6

Gallons available for sale or use (Subtract Line 5 from 4)

6. _____________________

Non-taxable disbursements:

7

Non-taxable use and other deductions (Total from Schedule C)

7. _____________________

8

Stock loss (Transfer to Line 4 GTD-300.) Stock gain (Transfer to Line 2 GTD-300.) Brackets for gain on worksheet only

8. _____________________

9

Total non-taxable gallons (Total of Line 7 & 8)

9. _____________________

Taxable disbursements:

10

Taxable sales to users (Total from Schedule E)

10. _____________________

11

Taxable use in own equipment (Total from Schedule F)

11. _____________________

12

Total taxable gallons sold & used (Total of Line 10 & 11)

12. _____________________

13

Gallons accounted for (Total line 9 & 12, must equal Line 6)

13. _____________________

14

Adjustments: Previously assessed (Transfer from Line 7 GTD-300)

Audit Tax

$ _____________________(Include in Line 18 total)

Penalty

$ _____________________(Include in Line 19 total)

Interest

$ _____________________(Include in Line 20 total)

15

Adjustments of prior month(s) report(s) (Total from Schedule Z) (Brackets for credits)

15. _____________________

16

Adjustments for taxes paid on bulk purchases (Total from Schedule B)

16. _____________________

17

Total taxable gallons (Line 12 plus or minus Line 15, minus Line 16) transfer to Line 5a and 6a GTD-300

17. _____________________

18

Total tax due (Line 14 Audit Tax plus Line 17 at current tax rate per gallon)

18. _____________________

19

Total sales and use tax equivalent (SUTE) (Mulitiply Line 17 by current SUTE equivalent rate) transfer to Line 6b GTD-300

19. _____________________

20

Total penalty due (Line 14 penalty plus current penalty, if delinquent) transfer to Line 7e GTD-300

20. _____________________

21

Total interst due (Line 14 interest plus current interst, if delinquent) transfer to Line 7f GTD-300

21. _____________________

22

Total to be paid (Line 18, 19, 20 and 21) transfer to Balance Due line of GTD-300

22. _____________________

The original schedules with the worksheet and with your form GTD-300 are to be mailed to:

Comptroller of Maryland, Revenue Administration Division, PO Box 2191, Annapolis, MD 21404-2191

For more information:

Visit our Web site at or call Taxpayer Service at 410-260-7980 in Central Maryland or 1-800-638-2937 from elsewhere. Send faxes to 410-974-3608.

Mail to: Comptroller of Maryland, Revenue Administration Division, PO Box 2191, Annapolis, MD 21404-2191.

COM/RAD-776-1

1

1