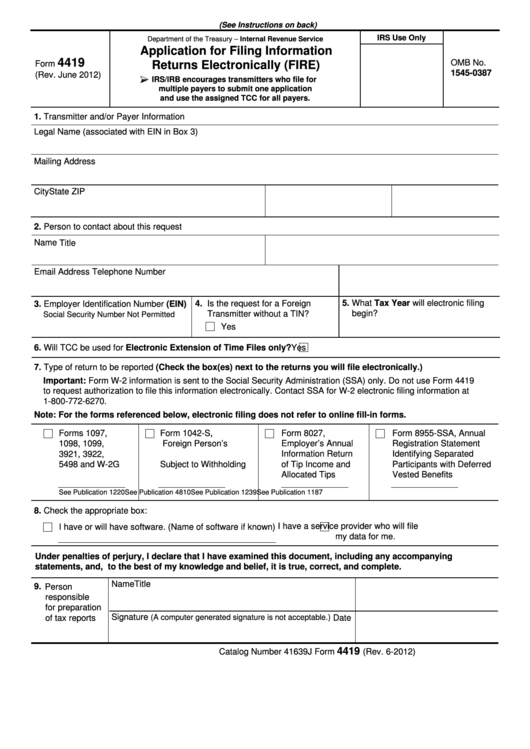

(See Instructions on back)

IRS Use Only

Department of the Treasury – Internal Revenue Service

Application for Filing Information

4419

OMB No.

Form

Returns Electronically (FIRE)

1545-0387

(Rev. June 2012)

IRS/IRB encourages transmitters who file for

multiple payers to submit one application

and use the assigned TCC for all payers.

1. Transmitter and/or Payer Information

Legal Name (associated with EIN in Box 3)

Mailing Address

City

State

ZIP

2. Person to contact about this request

Name

Title

Email Address

Telephone Number

5. What Tax Year will electronic filing

3. Employer Identification Number (EIN)

4. Is the request for a Foreign

begin?

Transmitter without a TIN?

Social Security Number Not Permitted

Yes

6. Will TCC be used for Electronic Extension of Time Files only?

Yes

7. Type of return to be reported (Check the box(es) next to the returns you will file electronically.)

Important: Form W-2 information is sent to the Social Security Administration (SSA) only. Do not use Form 4419

to request authorization to file this information electronically. Contact SSA for W-2 electronic filing information at

1-800-772-6270.

Note: For the forms referenced below, electronic filing does not refer to online fill-in forms.

Form 8027,

Form 8955-SSA, Annual

Forms 1097,

Form 1042-S,

1098, 1099,

Foreign Person’s

Employer’s Annual

Registration Statement

3921, 3922,

U.S. Source Income

Information Return

Identifying Separated

of Tip Income and

Participants with Deferred

5498 and W-2G

Subject to Withholding

Allocated Tips

Vested Benefits

See Publication 1220

See Publication 1187

See Publication 1239

See Publication 4810

8. Check the appropriate box:

I have a service provider who will file

I have or will have software. (Name of software if known)

my data for me.

Under penalties of perjury, I declare that I have examined this document, including any accompanying

statements, and, to the best of my knowledge and belief, it is true, correct, and complete.

Name

Title

9. Person

responsible

for preparation

Signature

(A computer generated signature is not acceptable.)

of tax reports

Date

4419

Catalog Number 41639J

Form

(Rev. 6-2012)

1

1 2

2