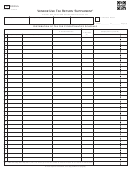

Form STS20021

Oklahoma Sales Tax Return ‘Supplement’ Instructions

Page 2

General Instructions

Complete Page 1 of Form STS20002 “Oklahoma Sales Tax Return”, item numbers 12 through 18 before completing the “supplement”.

Specific Instructions

ITEM A - Enter your taxpayer identification number.

ITEM B - Enter the month(s) and year for the use tax being reported. (Begin with the month when you made your first purchase).

ITEM C - Enter the date the return is due.

ITEM D - Enter your Account Number.

ITEM E - Check Box E if this is an amended return.

ITEM H - Enter each individual page number and the total number of pages enclosed.

City and County Tax Schedule Computation (Lines 19-44)

Column J -

Enter the code for each city/county for which you are remitting tax. If the code number is not known, call (405) 521-3279

for assistance.

Column K - Print the name of the city/county for which you are remitting tax.

Column L - Enter the “taxable sales” for each city/county associated with the code entered in Column J. If no “taxable sales” were

made, enter zero.

Column M - Enter the current sales tax rate for each city/county for which you are remitting tax.

Column N - Multiply the amounts in Column L times the rates in Column M and enter the sales tax due for each city/county.

ITEM O. TOTAL: Add Column N lines 19 through 44 and enter the total for this page in Item O. Add this total and the total of all supple-

ment pages to the total on Item O on page 1 of Form STS20002. Enter the combined totals on Form STS20002, Line 6.

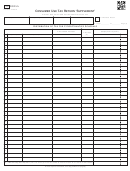

If additional supplemental pages are needed, download additional pages from our website at or call the Oklahoma Tax

Commission office at (405) 521-3160 and request the number of Sales Tax Return Supplement pages required.

Mandatory inclusion of Social Security and/or Federal Identification numbers is required on forms filed with the Oklahoma Tax Commis-

sion pursuant to Title 68 of the Oklahoma Statutes and regulations thereunder, for identification purposes, and are deemed part of the

confidential files and records of the Oklahoma Tax Commission.

The Oklahoma Tax Commission is not required to give actual notice of changes in any state tax law.

1

1 2

2