Form Dr 0200 - Colorado Baseball District Sales Tax Return)-Supplement

ADVERTISEMENT

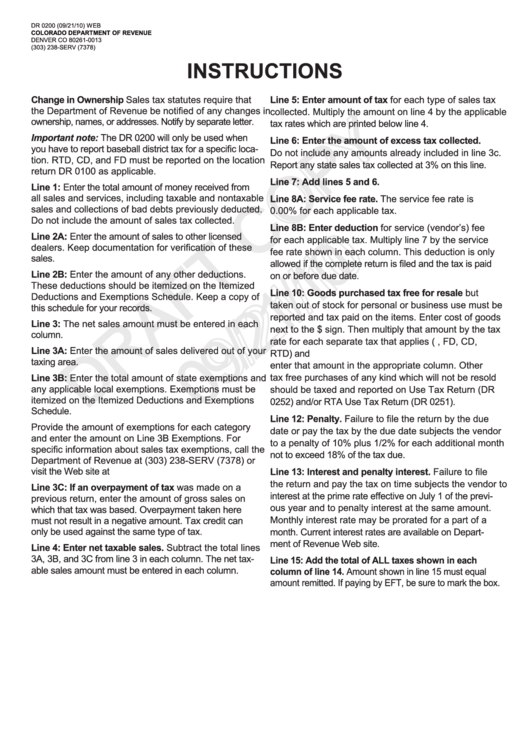

DR 0200 (09/21/10) WEB

COLOrADO DEPArtmEnt OF rEVEnuE

DENVER CO 80261-0013

(303) 238-SERV (7378)

InStruCtIOnS

Change in Ownership Sales tax statutes require that

Line 5: Enter amount of tax for each type of sales tax

the Department of Revenue be notified of any changes in

collected. Multiply the amount on line 4 by the applicable

ownership, names, or addresses. Notify by separate letter.

tax rates which are printed below line 4.

Important note: The DR 0200 will only be used when

Line 6: Enter the amount of excess tax collected.

you have to report baseball district tax for a specific loca-

Do not include any amounts already included in line 3c.

tion. RTD, CD, and FD must be reported on the location

Report any state sales tax collected at 3% on this line.

return DR 0100 as applicable.

Line 7: Add lines 5 and 6.

Line 1: Enter the total amount of money received from

all sales and services, including taxable and nontaxable

Line 8A: Service fee rate. The service fee rate is

sales and collections of bad debts previously deducted.

0.00% for each applicable tax.

Do not include the amount of sales tax collected.

Line 8B: Enter deduction for service (vendor’s) fee

Line 2A: Enter the amount of sales to other licensed

for each applicable tax. Multiply line 7 by the service

dealers. Keep documentation for verification of these

fee rate shown in each column. This deduction is only

sales.

allowed if the complete return is filed and the tax is paid

Line 2B: Enter the amount of any other deductions.

on or before due date.

These deductions should be itemized on the Itemized

Line 10: Goods purchased tax free for resale but

Deductions and Exemptions Schedule. Keep a copy of

taken out of stock for personal or business use must be

this schedule for your records.

reported and tax paid on the items. Enter cost of goods

Line 3: The net sales amount must be entered in each

next to the $ sign. Then multiply that amount by the tax

column.

rate for each separate tax that applies (e.g. BD, FD, CD,

Line 3A: Enter the amount of sales delivered out of your

RTD) and

taxing area.

enter that amount in the appropriate column. Other

tax free purchases of any kind which will not be resold

Line 3B: Enter the total amount of state exemptions and

any applicable local exemptions. Exemptions must be

should be taxed and reported on Use Tax Return (DR

itemized on the Itemized Deductions and Exemptions

0252) and/or RTA Use Tax Return (DR 0251).

Schedule.

Line 12: Penalty. Failure to file the return by the due

Provide the amount of exemptions for each category

date or pay the tax by the due date subjects the vendor

and enter the amount on Line 3B Exemptions. For

to a penalty of 10% plus 1/2% for each additional month

specific information about sales tax exemptions, call the

not to exceed 18% of the tax due.

Department of Revenue at (303) 238-SERV (7378) or

visit the Web site at

Line 13: Interest and penalty interest. Failure to file

the return and pay the tax on time subjects the vendor to

Line 3C: If an overpayment of tax was made on a

interest at the prime rate effective on July 1 of the previ-

previous return, enter the amount of gross sales on

ous year and to penalty interest at the same amount.

which that tax was based. Overpayment taken here

Monthly interest rate may be prorated for a part of a

must not result in a negative amount. Tax credit can

only be used against the same type of tax.

month. Current interest rates are available on Depart-

ment of Revenue Web site.

Line 4: Enter net taxable sales. Subtract the total lines

3A, 3B, and 3C from line 3 in each column. The net tax-

Line 15: Add the total of ALL taxes shown in each

able sales amount must be entered in each column.

column of line 14. Amount shown in line 15 must equal

amount remitted. If paying by EFT, be sure to mark the box.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4