Form Bt-22 - Alcoholic Beverage Tax - Summary Of Inventory Of Wholesalers And Manufacturers

ADVERTISEMENT

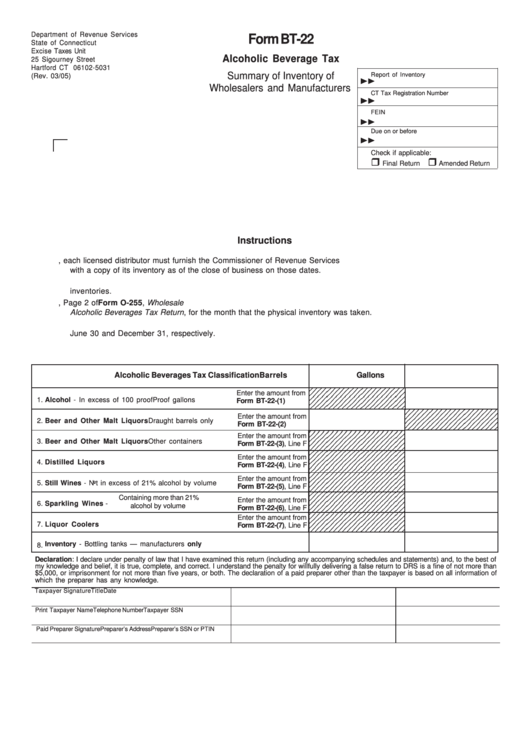

Department of Revenue Services

Form BT-22

State of Connecticut

Excise Taxes Unit

Alcoholic Beverage Tax

25 Sigourney Street

Hartford CT 06102-5031

Summary of Inventory of

Report of Inventory

(Rev. 03/05)

Wholesalers and Manufacturers

CT Tax Registration Number

FEIN

Due on or before

Check if applicable:

Final Return

Amended Return

Instructions

1. On June 30 and December 31, each licensed distributor must furnish the Commissioner of Revenue Services

with a copy of its inventory as of the close of business on those dates.

2. Electronic inventory sheets may be used provided they represent actual physical inventories and not book

inventories.

3. Barrels and Gallons reported on Lines 1 through 7 must agree with Line 7, Page 2 of Form O-255, Wholesale

Alcoholic Beverages Tax Return, for the month that the physical inventory was taken.

4. Submit this form and accompanying inventory schedules with the monthly return for the tax period ending on

June 30 and December 31, respectively.

Alcoholic Beverages Tax Classification

Barrels

Gallons

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

Enter the amount from

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1. Alcohol - In excess of 100 proof

Proof gallons

Form BT-22-(1)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

Enter the amount from

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

2. Beer and Other Malt Liquors

Draught barrels only

Form BT-22-(2)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

Enter the amount from

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

3. Beer and Other Malt Liquors

Other containers

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

Form BT-22-(3), Line F

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

Enter the amount from

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

4. Distilled Liquors

Form BT-22-(4), Line F

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

Enter the amount from

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

5. Still Wines - Not in excess of 21% alcohol by volume

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

Form BT-22-(5), Line F

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

Containing more than 21%

Enter the amount from

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

6. Sparkling Wines -

alcohol by volume

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

Form BT-22-(6), Line F

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

Enter the amount from

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

7. Liquor Coolers

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

Form BT-22-(7), Line F

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

8. Inventory - Bottling tanks — manufacturers only

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return to DRS is a fine of not more than

$5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of

which the preparer has any knowledge.

Taxpayer Signature

Title

Date

Print Taxpayer Name

Telephone Number

Taxpayer SSN

Paid Preparer Signature

Preparer’s Address

Preparer’s SSN or PTIN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1